The main rule of successful investment is the competent diversification of your assets

EUR/USD, USD/JPY, GBP/USD, USD/CAD, AUD/USD, USD/CHF, NZD/USD, EUR/JPY, EUR/GBP, EUR/CHF

SPX500, AAPL, AMZN, FB, GOOGL, JPM, MSFT, NVDA, TSLA, V

BTC/USD, ETH/USD, USOIL, XAU/USD, XNG/USD, UK100, DE30, FR40, HK50, JP225

Create your scenario.

Indicate the initial investment amount, monthly replenishment, investment period and risk level.

Create your scenario

10000

1000

60

Portfolio return

775 074 USD

Portfolio expected value

Total invested

398 000 USD

Expected income

Annual interest

120% per year

Expected return

Total: 750 074 USD

Each market has its own specifics.

With the right choice of financial instruments, you can build your profitable investment portfolio.

Investing means creating an investment portfolio for many years to come. Usually it is from 5 to 20 years.

The portfolio can be reviewed once a year or more often, depending on the situation on the markets.

Investment period from 5 to 20 years.

Creation of 5 sources of income (trading or investment instruments) of investment, it can be stocks, cryptocurrencies or trading / trust management in the forex market.

Use savings investment, add 10% of your income to your investment portfolio every month.

Strive for a long-term and stable income.

Observe money management and take into account any risks that may be. You don't have to worry when the markets are trending down.

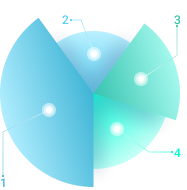

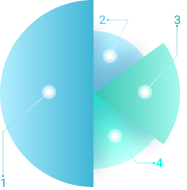

We recommend diversifying your funds among all our copy trading systems.

How diversification is working

Stable profit with less possible risks!

The Forex market is the most liquid market with a daily turnover of 7.5 trillion US dollars per day.

Market share of the most traded currency pairs: USD-88.5%, EUR-30.5%, JPY-16.7%, GBP-12.9%, AUD-7%, CAD-6.2%, CHF-5.5%.

Many currency pairs correlate with each other and here it is necessary to take this into account when trading forex.

There are 4 main types of forex trading: scalping (very frequent trading, highest risks), day trading, swing trading and fundamental trading (very rare trading, lowest risks).

Each trader chooses the style of trading for himself and there is no specific trading style winner, although most traders settle for day trading or swing trading.

Scalping is the most frequent trade and there are big risks of both loss and profit. Scalping is best done by a trader with good forex trading experience.

Day trading is less frequent than scalping and has a good balance of profit and risk. Many professional traders are engaged in day trading. The point of day trading is to find movement within the day and follow it. Typically, a trade is opened in the morning and closed in the evening.

Swing trading is a style of trading in which a trader can make short-term and medium-term profits over a period of several days to several weeks. Swing traders mainly use technical analysis to find trading opportunities.

Fundamental trading is most suitable for investors and traders who trade in their spare time, for whom trading is not the main activity. Fundamental trading usually has the lowest rate of return and, accordingly, risk. Trades can last from a couple of months to a year.

Buying and holding the most capitalized TOP 50 shares by capitalization.

Finding very undervalued stocks at the moment buying and holding them. In this case, the profitability may be higher than that of the top stocks, but these stocks are also subject to more risk than stocks from the top 50.

Here you can follow 2 strategies

Market of cryptocurrencies, energy, raw materials and financial indices:

Financial indices such as SPX500, DowJons, US30, FR40, UK50 are designed specifically for investorswho are committed to conservative investing. These indices give a maximum yield of 20-25% per annum. The average yield is 15% per year.

The commodity market is usually stable and similar to the forex market.

Usually forex traders also trade instruments from the commodity market.

Cryptocurrency is similar to investing in stocks, only it has even more risk and possible profitability.

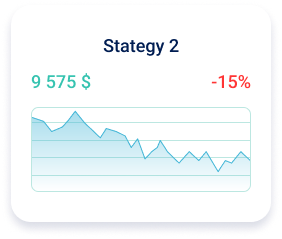

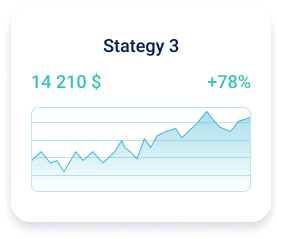

We have created 3 investment portfolios for the current year for you, and you can download our report, financial analytics and tips on compiling a portfolio for the current year.

Over 83,000 Forex traders worldwide trust FinanceWorld.io – now it’s your turn.

Trading alone is boring… Never trade alone again. Join to trading signals of FinanceWorld.io

Trading account in your Full Control

The choice to follow or not follow the signal is up to your wish. If you are not confident, don’t need to follow that signal.

If you are confident in some signal, you can follow it. You have full freedom to follow or Unfollow the trade signal.

Manual Signals provided by the good analyst are more accurate in nature.

You will know the technical analysis and reasons behind each and every manual trade given by the manual forex signals provider.

This helps you to trade with confidence on your forex account.

Hanges in Trend are easily identified earlier by Experienced Analyst.

Improves your Trading skills – The signals with technical analysis chart and market news updates will really improve your trading skills in real-time.

Subscribe to trading signals and make setup of signals (number of instruments, push or e-mail notifications)

Download our PWA app to instant access to all trading signals features using your mobile phone.

Here are the basic investing rules every investor should know:

1. Set clear financial goals.

2. Diversify your portfolio to reduce risk.

3. Understand your risk tolerance.

4. Invest for the long term and take advantage of compounding.

5. Conduct thorough research before making investment decisions.

6. Establish an emergency fund before investing in higher-risk assets.

7. Avoid making emotional decisions based on short-term market fluctuations.

8. Regularly review and rebalance your portfolio to maintain desired asset allocation.

9. Stay informed about tax implications of investments.

10. Seek professional advice if needed.

The best investment strategy for long-term growth involves diversification, consistent contributions, and a focus on low-cost, passive investing. It is important to spread investments across different asset classes and geographic regions to reduce risk. Determine an appropriate asset allocation based on your risk tolerance and financial goals. Regularly contribute money to your portfolio through systematic investments to take advantage of dollar-cost averaging. Consider investing in low-cost index funds or ETFs that track broad market indices instead of actively managed funds. Periodically review and rebalance your portfolio to maintain desired risk exposure. Practice patience and discipline by staying invested even during market volatility. Seek personalized guidance from a financial advisor considering your unique circumstances.

Diversifying your investment portfolio is generally recommended to spread risk and potentially increase returns. The ideal diversification strategy includes asset allocation across different classes, geographic diversification, sector diversification, company size diversification, time diversification through regular investments, and periodic rebalancing. However, thorough research or consulting with a financial advisor is crucial before making any investment decisions as diversification does not guarantee profits or protect against losses entirely.

Common mistakes to avoid while investing in the stock market include:

1. Lack of research on companies before investing.

2. Making emotional decisions based on fear or greed.

3. Overtrading and excessive buying/selling of stocks.

4. Failure to diversify investments across different sectors and asset classes.

5. Trying to time the market instead of having a long-term investment strategy.

6. Ignoring fundamental analysis and relying on rumors or short-term price movements.

7. Neglecting risk management by not setting stop-loss orders or having an exit strategy.

8. Following the herd mentality without conducting independent analysis.

9. Being overconfident in investment decisions and taking excessive risks.

10. Not having a long-term perspective and expecting quick profits.

To avoid these mistakes, investors should conduct thorough research, make informed decisions based on fundamentals, diversify their portfolio, have a long-term strategy, manage risk effectively, and avoid emotional decision-making or following popular trends blindly.

To determine your risk tolerance before making investment decisions:

1. Assess your financial goals and long-term objectives.

2. Evaluate your time horizon for investing.

3. Analyze personal circumstances like age, income stability, and financial obligations.

4. Understand different asset classes and their associated risks.

5. Take a risk tolerance questionnaire or seek advice from a financial advisor.

6. Consider emotional factors and how you would react to market fluctuations.

7. Periodically reassess your risk tolerance as it can change over time.

By considering these factors, you can better understand the level of risk you are comfortable with when making investment decisions.

Subscribe to our social network channels to receive the most relevant information in demand on the financial markets.

Best Seller Book (Free Download)

(best secrets from millionaires and billionaires)

Risk Disclosure and Disclaimer: FinanceWorld (FinanceWorld.io) is a financial analytical company that provides information about financial markets for traders and investors worldwide. We introduce people to the world of financial markets and deliver information, content, service, software, programs, and products to help them become profitable traders or investors in financial markets. All services and content on site or somewhere else under FinanceWorld’s name are provided “as is” without warranty.

Past performance is no guarantee of future results. The investments and services offered by us may not be suitable for all investors. FinanceWorld Inc. provides only financial management and provides remote management of orders on clients’ accounts. All trading or investment decisions are fully on responsibility of the account owner and include but are not limited to any kind of loss of capital.

Users, visitors, and customers can use all our products, software, programs, services, content, and information at their own risk, and 100% responsibility lies on them. Although we have vast experience in working with financial markets, we do not carry any guarantee of profitability under any circumstances. We also do not bear any responsibility or warranty for our services, software, programs, products, contents, or information under the name of FinanceWorld or FinanceWorld.io received from any sources, both online and offline. Any user, visitor, or customer must independently make a decision and take 100% responsibility to himself for making a decision.

Subscriber accepts all execution risks when subscribing to Trading Signals, Trading Ideas, and Copy Trading strategy/strategies. Historical statistics cannot guarantee any profitability in the future. Trading or investing is not suitable for everyone. If you don’t know what you are doing, trading or investing can cause you to lose all of your money. Please see our Privacy Policy and Terms & Conditions for the full text of the disclaimer.

| Symbol | Type | Open Time | Close Time | Open Price | Close Price | Profit |

|---|