Financial Market Analysis Academy: Learn Essential Market Tools

Best Financial Courses For Smart Trading

FinanceWorld.io provides beginner-friendly courses and programs to equip individuals with the necessary knowledge and tools to confidently navigate financial markets, including trading, and investing.

You Are In The Place Where You Are Mastering Financial Markets

Calculate The Profitability Of Your Assets:

Create your scenario

3000

0

60

Portfolio return

775 074 USD

Portfolio expected value

Total invested

398 000 USD

Expected income

Annual interest

120% per year

Expected return

Total: 750 074 USD

Learn Trading

Calculate Income Scenario

Register at FinanceWorld and Top Brokers to Start Trading

Complete This Course And We Will Connect Your Account To Our Copy Trading Systems for Free

Join our beginner-friendly course for cryptocurrency trading, mastering market analysis, risk management, and practical strategies. Enhance skills and confidence, transforming beginners and experienced traders.

Complete This Course And We Will Connect Your Account To Our Copy Trading Systems for Free

Join our beginner-friendly day trading course, which covers strategies, market mechanics, technical analysis, risk management, psychological factors, chart reading, hardware/software requirements, legal and tax implications, and premium trade signals.

Complete Any of Our Courses and Receive a Gift

We give a gift of 3 months of access to trading signals for free to everyone who has completed at least one of our courses. To do this, the following condition must be met: You must complete the course 100% and then write to the support service and your subscription for 3 months to trading signals will be activated.

Free 3-Month Trading Signals Access

Best Seller Book (Free Download)

(best secrets from millionaires and billionaires)

Join our free community to start earning and receiving profitable results from financial markets through our notifications and information.

Day Trading Course Overview

Crypto Trading Course Overview

Course on Commercial and Residential Real Estate

Swing Trading Course Overview

Forex Trading Course Overview

Course on Options Trading Complexities

Comprehensive Stock Trading Course

Investing in Stock Market Course Overview

Specialized Course on Futures Trading

Forex Market Overview

Stocks & Indexes Overview

Crypto & Commodities Overview

Scalping is the most frequent trade and there are big risks of both loss and profit. Scalping is best done by a trader with good forex trading experience.

Day trading is less frequent than scalping and has a good balance of profit and risk. Many professional traders are engaged in day trading. The point of day trading is to find movement within the day and follow it. Typically, a trade is opened in the morning and closed in the evening.

Swing trading is a style of trading in which a trader can make short-term and medium-term profits over a period of several days to several weeks. Swing traders mainly use technical analysis to find trading opportunities.

Fundamental trading is most suitable for investors and traders who trade in their spare time, for whom trading is not the main activity. Fundamental trading usually has the lowest rate of return and, accordingly, risk. Trades can last from a couple of months to a year.

Buying and holding the most capitalized TOP 50 shares by capitalization.

Finding very undervalued stocks at the moment buying and holding them. In this case, the profitability may be higher than that of the top stocks, but these stocks are also subject to more risk than stocks from the top 50.

Here you can follow 2 strategies

Market of cryptocurrencies, energy, raw materials and financial indices:

Cryptocurrency Investment Overview

Commodity Market Stability and Forex Trading

Energy Market Overview

Reliable Trading Signals

Copy Trading Service: Utilize seasoned traders’ expertise.

Exclusive Access to Hedge Fund Strategies

Online Trading Tools: Enhancing Trading Efficiency

Activate Free or Paid Plan

Generate Your Profit

Our services we are providing using Metatrader 4 and Metatrader 5 platforms because its leaders on retail trading market.

You can learn more about platforms here:

Looking for a trustworthy broker?

We partner with the industry’s leading regulated brokers to bring you the best options available.

Our recommended retail brokers have been vetted for reliability, security, and exceptional service.

Explore our top picks below and find your perfect trading partner today!

Step 2

You can start with us for free, if your account is small, check profitability with us.

Step 3

When you will decide start your profitable trading with us, you can choose trading signals (recommended account amount from 200 USD to 2 000 USD) or copy trading (recommended account amount from 2 000 USD to 10 000 USD).

Step 4

You can diversify your accounts between our copy trading strategies and get stable profit.

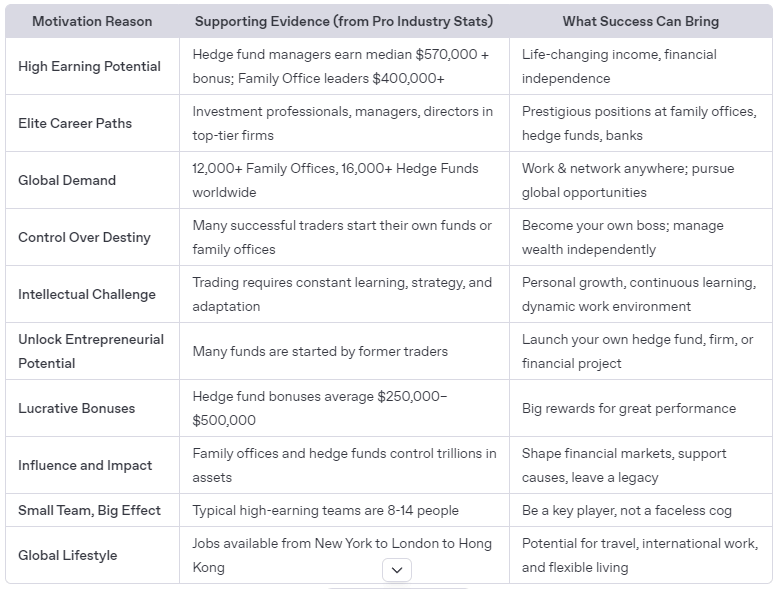

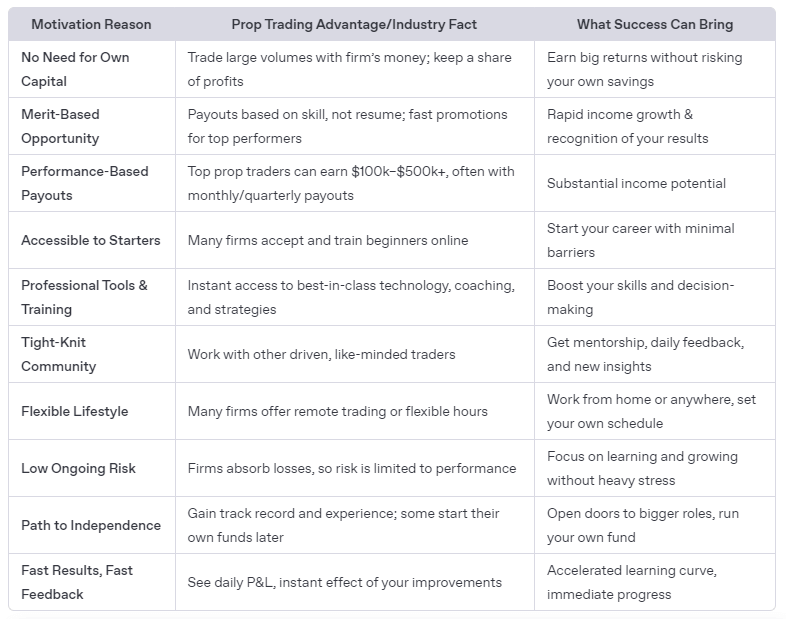

Find out why millions of traders and investors use the services of FinaceWorld.io

Copy Trading allows you to copy our main account and gain a profit of approximately 120% per annum without any knowledge about trading.

Subscribe to trading signals and get instant notifications when enter or exit the market.

Hedge Fund allows you to copy our main account and gain a profit of approximately 150% per annum without any knowledge about trading.

You can ask us anything about Copy Trading and Trading Signals!

Fill the form or send us the message.

Access to All 30 Trading Instruments

Turn On and Turn Off Instruments

E-Mail Notifications

WEB Push Notifications

Mobile Push Notifications

Over 7,000 Forex and Stock Traders Worldwide Trust FinanceWorld.io – Now It’s Your Turn.

Trading Alone is Boring… Never Trade Alone Again. Join to Trading Signals of FinanceWorld.io

You have your finger on the pulse and are in complete control of everything.

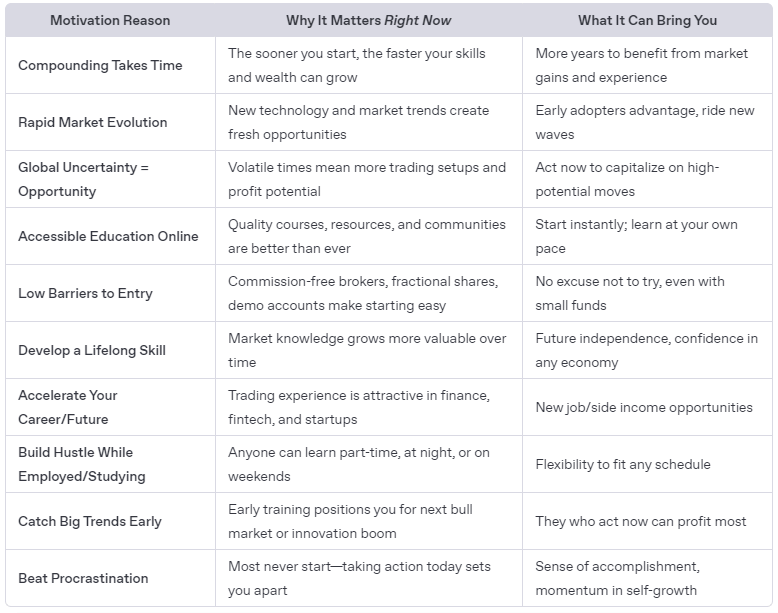

Trading and investing are two different approaches to participating in financial markets. Trading aims to generate short-term profits by taking advantage of price fluctuations, while investing focuses on building long-term wealth through asset appreciation or income generation. Traders have a short time horizon, use technical analysis, and engage in frequent buying and selling. Investors have a longer time horizon, use fundamental analysis, and make decisions based on long-term growth prospects. Trading carries higher risk due to its reliance on market volatility, while investing tends to be more passive and diversified.

To get started with trading and investing:

1. Educate yourself about trading and investing through books, articles, and online resources.

2. Set financial goals and determine your risk tolerance.

3. Create a budget that allows you to allocate funds for trading or investing.

4. Open a brokerage account with a reputable firm.

5. Start small and gradually increase your investments as you gain experience.

6. Diversify your portfolio across different asset classes and sectors.

7. Stay informed about market trends and relevant news.

8. Be patient, as investing is a long-term game.

9. Consider seeking professional advice if needed.

Remember to thoroughly research the market and understand the risks involved before making any investment decisions.

Here are some common investment strategies for beginners:

1. Dollar-cost averaging: Invest a fixed amount regularly, regardless of market conditions.

2. Index fund investing: Invest in funds that replicate the performance of market indexes.

3. Buy and hold: Hold onto investments for the long term, ignoring short-term market volatility.

4. Diversification: Spread investments across different asset classes to reduce risk.

5. Robo-advisors: Use online platforms that create and manage diversified portfolios based on individual goals.

6. Education and research: Learn about various investment options and stay informed about market trends.

7. Establish an emergency fund: Set aside money to cover living expenses in case of unexpected financial challenges.

8. Start small: Begin with smaller amounts to gain confidence before committing larger sums.

Remember to seek professional advice or do thorough research before making any investment decisions.

The amount of money needed to start trading or investing can vary depending on the type of investment. For stock trading, it is generally recommended to have at least $1,000 to $2,000. Mutual funds and index funds may have minimum initial investments ranging from a few hundred to several thousand dollars, while ETFs can be purchased with no minimum requirement. Real estate investing requires varying amounts based on property type and location. Robo-advisors typically have low minimum investment requirements starting from $0 or $500. It’s important to assess your financial situation and consult with a financial advisor before making any investment decisions.

To minimize risks while trading or investing, follow these strategies:

1. Diversify your portfolio across different assets and sectors.

2. Conduct thorough research on investments before making decisions.

3. Set clear goals and understand your risk tolerance.

4. Take a long-term perspective to mitigate short-term market fluctuations.

5. Use stop-loss orders to limit potential losses.

6. Stay updated with news and events that could impact the markets.

7. Avoid emotional decision-making and stick to your strategy.

8. Consider seeking professional advice from financial experts.

9. Regularly review and rebalance your portfolio to maintain diversification.

10. Understand the risks associated with different types of investments.

Remember that investing always carries some level of risk, so it’s important to assess your financial situation and consult professionals when needed.

A brokerage account is an intermediary platform that facilitates trading and investing in various financial assets. It allows individuals to execute trades, access financial markets, and provides custodial services for holding securities electronically. Brokerage accounts often offer research tools, margin trading facilities, and record-keeping/reporting services. Some brokers also provide investment advice and account management tools. Investors should consider fees and choose a brokerage account that suits their needs.

Diversification in investment portfolios is a risk management strategy that involves spreading investments across different assets, sectors, geographic regions, and time periods. By diversifying, investors aim to reduce the overall risk of their portfolio by not relying on the performance of a single investment. This strategy helps protect against significant downturns as losses in one investment may be offset by gains in others. Diversification does not guarantee profits or protect against losses entirely but aims to balance risk and potentially enhance returns by capturing growth opportunities across various segments of the market.

Common mistakes that beginners should avoid while trading or investing include:

1. Lack of research and understanding the fundamentals.

2. Making emotional decisions driven by fear or greed.

3. Overtrading, which increases costs and risks.

4. Not diversifying investments across different sectors or asset classes.

5. Ignoring risk management by not setting stop-loss levels or using appropriate position sizing techniques.

6. Chasing hot tips or trends without conducting proper analysis.

7. Neglecting a long-term perspective and focusing too much on short-term market movements.

8. Failing to have an exit strategy with predefined profit targets and stop-loss levels.

9. Not learning from past mistakes and analyzing losses to improve decision-making.

10. Neglecting ongoing education about investment strategies, market trends, and economic indicators.

Overall, beginners should prioritize research, rational decision-making, risk management, diversification, long-term perspective, exit strategies, learning from mistakes, and ongoing education in order to avoid these common pitfalls in trading or investing.

Subscribe to our social network channels to receive the most relevant information in demand on the financial markets.

Successful trading experience from 2013.

Look At My Biography and My Levels Of Success And Learn More About Me.

I Share Some of My Trades on Public Accounts on Linkedin. Subscribe to Me to Get My Updates.

Best Seller Book (Free Download)

(best secrets from millionaires and billionaires)

Risk Disclosure and Disclaimer: FinanceWorld (FinanceWorld.io) is a financial analytical company that provides information about financial markets for traders and investors worldwide. We introduce people to the world of financial markets and deliver information, content, service, software, programs, and products to help them become profitable traders or investors in financial markets. All services and content on site or somewhere else under FinanceWorld’s name are provided “as is” without warranty.

Past performance is no guarantee of future results. The investments and services offered by us may not be suitable for all investors. FinanceWorld Inc. provides only financial management and provides remote management of orders on clients’ accounts. All trading or investment decisions are fully on responsibility of the account owner and include but are not limited to any kind of loss of capital.

Users, visitors, and customers can use all our products, software, programs, services, content, and information at their own risk, and 100% responsibility lies on them. Although we have vast experience in working with financial markets, we do not carry any guarantee of profitability under any circumstances. We also do not bear any responsibility or warranty for our services, software, programs, products, contents, or information under the name of FinanceWorld or FinanceWorld.io received from any sources, both online and offline. Any user, visitor, or customer must independently make a decision and take 100% responsibility to himself for making a decision.

Subscriber accepts all execution risks when subscribing to Trading Signals, Trading Ideas, and Copy Trading strategy/strategies. Historical statistics cannot guarantee any profitability in the future. Trading or investing is not suitable for everyone. If you don’t know what you are doing, trading or investing can cause you to lose all of your money. Please see our Privacy Policy and Terms & Conditions for the full text of the disclaimer.

| Symbol | Type | Open Time | Close Time | Open Price | Close Price | Profit |

|---|