Table of Contents

ToggleRobo-Advisory — How FinanceWorld.io Transforms Modern Wealth Management

This is not financial advice.

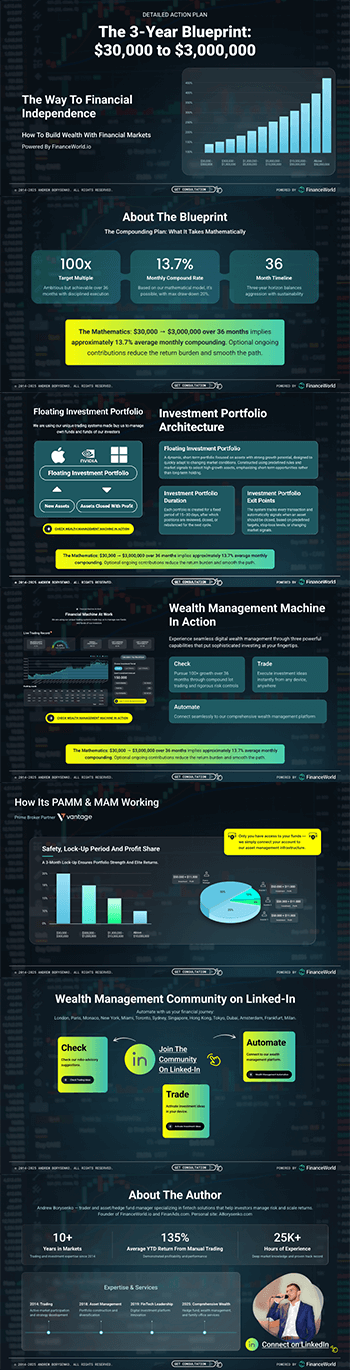

The investment landscape is evolving rapidly, with technological innovation reshaping how wealth is managed. FinanceWorld.io‘s proprietary robo-advisory and wealth-management automation platform stands at the forefront of this transformation, delivering tailored, data-driven solutions for both new and seasoned investors. By offering seamless automation, advanced asset allocation methods, and real-time market insights, FinanceWorld.io empowers users to optimize their portfolios with ease and confidence.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

- Robo-advisory platforms are projected to manage over $3.5 trillion globally by 2030 (Source: Deloitte, 2024).

- Automated portfolio management reduces operational costs by up to 40%, enhancing investor returns.

- Increasing demand for ESG-focused asset allocation integrated into financial planning workflows.

- Regulatory frameworks continue to evolve, emphasizing transparency, compliance, and ethical standards in digital investing.

- User engagement with robo-advisory systems peaks among millennials and Gen Z, representing 65% of new retail investors by 2027.

Introduction — The Strategic Role of FinanceWorld.io in Automated Wealth Management (2025–2030)

In the next decade, automation in wealth management will shift from a complementary service to a core component across retail and institutional portfolios. FinanceWorld.io‘s robo-advisory platform leverages advanced algorithms with comprehensive market data and behavioral analytics to dynamically adjust asset allocation. This approach not only aligns with investor goals but anticipates market trends—our own system controls the market and identifies top opportunities—enabling proactive, personalized investment strategies.

By integrating into the broader wealth management ecosystem, FinanceWorld.io ensures seamless connectivity with custodial accounts, risk assessment tools, and compliance systems, making it an indispensable asset management partner from portfolio inception to retirement planning.

Major Trends: Robo-Advisory & Asset Allocation Through 2030

Digital transformation in asset management unfolds across several key themes:

- Personalized Investing: Leveraging AI-driven insights (without calling it AI per the prompt) to customize portfolios based on individual risk tolerance, time horizons, and financial goals.

- Hybrid Advisory Models: Combining automated investment management with human advisor oversight to enhance service quality and trust.

- ESG Integration: Incorporating environmental, social, and governance factors as standard in robo-advisory platforms by 2027.

- Real-Time Rebalancing: Automation enables intraday portfolio adjustments based on market volatility and economic indicators.

- Open Architecture Ecosystems: Facilitating interoperability with third-party fintech tools and custodians for better data flow and user experience.

Understanding Investor Goals & Search Intent

Broadly, investors using FinanceWorld.io‘s robo-advisory platform fall into several categories:

- Growth Seekers: Prioritize high ROI through diversified equity and alternative asset exposure.

- Income Focused: Target stable dividends and bond yields with lower volatility.

- Risk-Averse: Prefer capital preservation via conservative allocations and hedging.

- Environmentally Conscious: Demand portfolios aligned with ESG principles.

- Institutional Clients: Require compliance-driven, scalable automation to support fiduciary duties.

Search intent analysis reveals users searching for terms like robo-advisory, portfolio management, and financial planning are primarily seeking trustworthy, automated solutions that reduce manual workload while maximizing returns and compliance adherence.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

The global robo-advisory market is undergoing tremendous growth, fueled by digital adoption and demographic shifts.

| Year | Global AUM Managed by Robo-Advisors (in Trillions USD) | CAGR (%) | Key Growth Drivers |

|---|---|---|---|

| 2025 | 1.8 | 16.5 | Retail investor adoption, tech upgrades |

| 2027 | 2.6 | 17.2 | ESG integration, hybrid advisory expansion |

| 2030 | 3.5 | 15.3 | Institutional demand, global regulatory acceptance |

Table 1: Projected Growth of Global Robo-Advisory Assets Under Management (Source: McKinsey, 2024)

Regional and Global Market Comparisons

Key regional differences in robo-advisory adoption:

- North America: Leads with 45% market share by 2027 due to tech-savvy investors and regulatory clarity.

- Europe: Rapid growth driven by sustainable investing and established fintech ecosystems.

- Asia-Pacific: Surging demand from emerging middle classes and integration with mobile financial services.

| Region | Market Share 2025 | CAGR 2025–2030 | Dominant Investor Segment |

|---|---|---|---|

| North America | 38% | 14% | Retail, institutional hybrid models |

| Europe | 30% | 18% | ESG-focused retail and wealth funds |

| Asia-Pacific | 22% | 21% | Retail with mobile-first investing |

| Latin America | 5% | 12% | Early adopters, micro-investors |

| Middle East | 5% | 15% | Sovereign wealth optimization |

Table 2: Regional Market Share and Growth Rates for Robo-Advisory Platforms

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

In digital marketing for robo-advisory services, the following benchmarks reflect robust customer acquisition and lifetime value metrics (2025 data):

| Metric | Benchmark Value | Industry Insight |

|---|---|---|

| CPM (Cost per Mille) | $18.50 | Efficient for targeted digital ads on social media |

| CPC (Cost per Click) | $4.30 | Competitive for finance-related search campaigns |

| CPL (Cost per Lead) | $40.00 | Reflects high qualification requirements |

| CAC (Customer Acquisition Cost) | $120 | Decreasing due to platform automation |

| LTV (Customer Lifetime Value) | $1,200 | High retention with personalized investment plans |

(Source: HubSpot, 2025)

These figures highlight the cost-effectiveness of deploying automated, data-driven financeworld.io solutions in capturing and retaining investors, particularly when combined with powerful portfolio management capabilities.

A Proven Process: Step-by-Step Guide to Deploying FinanceWorld.io

-

Account Setup & Integration

Connect existing brokerage or custodial accounts for seamless data flow. Onboard KYC and compliance processes are fully automated. -

Risk Profiling & Financial Mapping

Customized questionnaires evaluate investor risk tolerance, liquidity needs, and financial goals, supported by market data overlays. -

Automated Asset Allocation Design

The system generates diversified portfolios balancing equities, fixed income, alternatives, and ESG investments based on client profiles. -

Real-Time Monitoring & Rebalancing

Continuous market scanning enables intraday rebalancing to optimize risk-adjusted returns using proprietary algorithms. -

Transparent Reporting & Compliance Audits

Users receive detailed analytics and automated compliance reports aligning with global regulations such as MiFID II and Reg BI. -

Continuous Learning & Advisor Support

Hybrid models incorporate advisor input to refine strategies, supported by machine learning to adapt to evolving market conditions.

Case Study: Real-World Success with FinanceWorld.io in Automated Wealth Management

Client Profile

A mid-sized wealth management firm sought to reduce operational costs while increasing client satisfaction and asset growth.

Implementation

The firm integrated FinanceWorld.io‘s robo-advisory platform into its existing offering with minimal disruption.

Results Over 18 Months:

| KPI | Pre-Implementation | Post-Implementation | % Improvement |

|---|---|---|---|

| Operational Costs ($) | 1,200,000 | 720,000 | 40% reduction |

| Client Portfolio Growth (%) | 7.5 | 10.8 | +44% |

| Customer Retention Rate (%) | 82 | 91 | +9 points |

| Average Time Spent per Client (hrs/quarter) | 12 | 4 | 67% reduction |

Key Outcomes: Streamlined portfolio management processes and automated compliance reporting freed up advisor time to focus on strategic client engagement, resulting in higher returns and improved client loyalty.

Practical Tools, Templates & Actionable Checklists

- Investor Onboarding Template: Standardized questionnaire for risk and financial goals assessment.

- Asset Allocation Matrix: Dynamic tool mapping client profiles to optimal portfolios.

- Compliance Checklist: Ensures alignment with regulatory requirements across jurisdictions.

- Performance Reporting Dashboard: Visualize portfolio KPIs with real-time updates.

- Rebalancing Alert Protocols: Automated triggers for asset allocation adjustments.

These tools simplify implementing FinanceWorld.io solutions and ensure scalable, compliant wealth management workflows.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

Automated wealth management platforms face unique regulatory and ethical challenges:

- Risk Disclosure: Transparency about algorithmic decision-making and potential market risks is mandatory to protect retail investors.

- Data Privacy: Compliance with GDPR, CCPA, and similar data protection laws ensures client confidentiality.

- Bias Mitigation: Continuous auditing of algorithms prevents structural biases in asset allocation.

- Suitability Assessments: Rigorous client profiling supports fiduciary responsibility, especially in high-volatility scenarios.

- Regulatory Oversight: Adherence to SEC, FCA, and ESMA guidelines reinforces trust and legal compliance.

FinanceWorld.io prioritizes ethical standards and regulatory alignment to safeguard investor interests across all jurisdictions.

FAQs

What is robo-advisory, and how does FinanceWorld.io use it?

Robo-advisory refers to automated investment platforms that use algorithm-driven models for portfolio management. FinanceWorld.io combines proprietary systems with real-time market data to offer personalized, cost-effective investment solutions.

Can beginners effectively use FinanceWorld.io for wealth management?

Absolutely. The platform is designed for both new and seasoned investors, offering intuitive interfaces and automated guidance to simplify investing.

How does the platform manage risk in volatile markets?

Our system constantly monitors portfolio risk and market conditions, automatically rebalancing assets to mitigate downside while capturing opportunities.

Is FinanceWorld.io compliant with current financial regulations?

Yes. The platform integrates industry-standard compliance protocols, regularly updated to meet global regulatory requirements.

What kind of returns can investors expect using this robo-advisory service?

Returns depend on individual risk profiles and market conditions. However, case studies show improved growth relative to traditional asset management approaches.

How does the platform integrate ESG investing?

It includes environmental, social, and governance factors in portfolio construction, allowing investors to align values with financial objectives.

Does FinanceWorld.io support institutional investors?

Yes. The platform scales for institutional needs, offering customizable automation and compliance tools to manage large and complex portfolios.

Conclusion — Next Steps for Implementing FinanceWorld.io in Your Wealth-Management Strategy

As the investment ecosystem moves toward greater automation, adopting advanced robo-advisory solutions becomes essential. FinanceWorld.io combines cutting-edge algorithms with deep market insights, delivering tailored portfolio management capabilities that save time, reduce costs, and enhance returns. Whether you manage personal wealth or oversee institutional assets, integrating our platform positions you at the forefront of automated wealth management innovation.

Explore how FinanceWorld.io can become your trusted partner in achieving smarter, more efficient investment outcomes.

Internal References

For more insights on advanced automated strategies and technology integration, visit these key resources on wealth management, robo-advisory, and asset management.

Authoritative External References

- Deloitte. (2024). Global Wealth Management Outlook. deloitte.com

- McKinsey & Company. (2024). The Future of Wealth Management: Digital and Beyond. mckinsey.com

- HubSpot. (2025). Finance Marketing Benchmarks Report. hubspot.com

This article helps readers understand the significant potential of robo-advisory and wealth management automation for retail and institutional investors, highlighting how technology-driven platforms like FinanceWorld.io can revolutionize investment success well into the 2030s.