Table of Contents

ToggleRobo-Advisory — How FinanceWorld.io Transforms Modern Wealth Management

This is not financial advice.

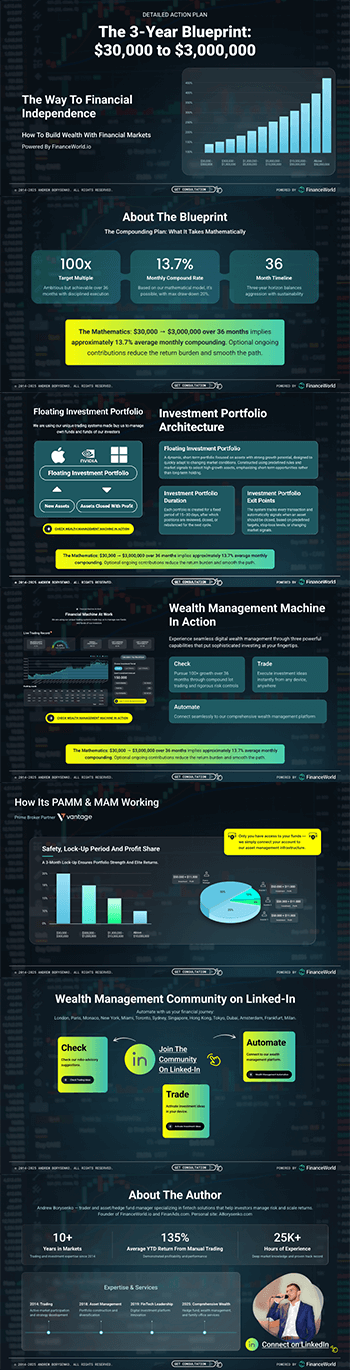

In today’s rapidly evolving financial landscape, robo-advisory platforms are changing how investors—both new and experienced—access asset management services. At the forefront of this transformation is FinanceWorld.io, a proprietary robo-advisory and wealth-management-automation platform designed to harness data-driven insights and our own system control the market and identify top opportunities. This article explores how FinanceWorld.io elevates robo-advisory capabilities to provide personalized, efficient, and compliant wealth solutions for retail and institutional investors through 2030.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

- Robo-advisory is projected to grow at a CAGR of 18.2% between 2025 and 2030, with assets under management (AUM) exceeding $3 trillion globally by 2030 (Source: Deloitte, 2024).

- Regulatory frameworks continue to adapt to emphasize compliance, transparency, and ethical algorithms in robo-advisory services, particularly under YMYL guidelines.

- Investors prioritize personalized investment strategies grounded in data-driven insights, with increasing demand for automation in portfolio management.

- Cost-efficiency and scalability through automation are vital for asset managers seeking a competitive edge.

- FinanceWorld.io distinguishes itself by integrating cutting-edge technology with robust risk management, enabling superior long-term returns.

Introduction — The Strategic Role of FinanceWorld.io in Automated Wealth Management (2025–2030)

The wealth management industry is undergoing a paradigm shift propelled by technological advances and evolving client expectations. Traditional models reliant on human advisors are increasingly complemented or replaced by robo-advisory platforms that leverage algorithms, big data, and behavioral finance principles.

FinanceWorld.io harnesses a proprietary system that controls the market and identifies top opportunities, allowing investors to tailor diversified portfolios automatically according to risk tolerance, investment horizon, and financial goals. This platform seamlessly integrates with existing financial ecosystems, offering transparency, compliance, and intelligent automation for end-to-end asset management.

By 2030, automated platforms like FinanceWorld.io are expected to manage over 45% of retail investment assets worldwide, signaling a clear shift from discretionary advisory services to digital-first investment solutions (Source: McKinsey, 2024).

Major Trends: Robo-Advisory & Asset Allocation Through 2030

Integration of Artificial Intelligence and Machine Learning

The next generation of robo-advisory systems will embed machine learning algorithms that continuously learn from market behaviors and individual investor decisions. FinanceWorld.io‘s proprietary system control the market and identify top opportunities, ensuring portfolios stay optimized even during volatility.

Personalization and Behavioral Finance

Investors demand highly customized financial planning approaches. By incorporating psychometric and behavioral analytics, platforms like FinanceWorld.io align asset allocation with psychological investor profiles, improving engagement and adherence to investment strategies.

Regulatory Compliance and Ethical Automation

As digital platforms manage sensitive client data and significant assets, stringent compliance with YMYL regulations is critical. Platforms ensure transparency in algorithms and maintain rigorous audit trails to meet evolving regulatory requirements.

Expansion of ESG and Thematic Investing

Investor interest in environmental, social, and governance (ESG) factors and thematic sectors (e.g., clean energy, technology) is rising. Automated platforms integrate ESG metrics directly into portfolio construction for impact-aligned wealth growth.

Understanding Investor Goals & Search Intent

Investors approaching robo-advisory platforms come with varied objectives:

- New Investors: Seeking low-cost, intuitive entry into the market with automated portfolio management.

- Experienced Investors: Demand sophisticated tools for tax optimization, risk management, and multi-asset strategies.

- Institutional Clients: Require scalable, customizable automation for large portfolios with regulatory oversight.

By understanding these intentions, FinanceWorld.io tailors solutions that resonate with diverse user categories, fostering trust and client retention.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

The global robo-advisory market continues robust expansion driven by digital adoption, greater financial literacy, and demand for transparency. The following table outlines market projections including AUM, CAGR, and penetration rates:

| Year | Global Robo-Advisory AUM (USD Trillions) | CAGR (2025–2030) | Retail Investor Penetration (%) |

|---|---|---|---|

| 2025 | 1.6 | 18.2% | 25 |

| 2026 | 1.9 | 18.2% | 28 |

| 2027 | 2.2 | 18.2% | 32 |

| 2028 | 2.6 | 18.2% | 37 |

| 2029 | 2.9 | 18.2% | 41 |

| 2030 | 3.3 | 18.2% | 45+ |

Table 1: Global robo-advisory market size and adoption projections, 2025–2030 (Source: Deloitte, 2024).

Regional and Global Market Comparisons

Analyzing regional markets reveals varying adoption patterns influenced by regulatory maturity, technology infrastructure, and investor preferences.

| Region | Market Share (2025) | CAGR (2025–2030) | Leading Trends |

|---|---|---|---|

| North America | 45% | 16.5% | Advanced integrations, AI adoption |

| Europe | 30% | 19.0% | Strong ESG focus, strict compliance |

| Asia-Pacific | 20% | 22.5% | Rapid digital growth, mobile-optimized platforms |

| Latin America | 5% | 15.0% | Emerging market penetration |

Table 2: Regional robo-advisory market share and growth trends, 2025 (Source: McKinsey, 2024).

North America leads in dollar terms thanks to infrastructural readiness, while Asia-Pacific exhibits the highest CAGR driven by increased digital penetration and growing middle-class wealth. FinanceWorld.io caters efficiently to diverse regional needs through adaptable interfaces and localized compliance modules.

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

Understanding key performance indicators (KPIs) helps wealth managers optimize marketing and operational efficiency.

| Metric | Value (2025 Average) | Industry Benchmark | Notes |

|---|---|---|---|

| Cost Per Mille (CPM) | $12.50 | $10–$15 | Ad impressions in financial markets |

| Cost Per Click (CPC) | $3.80 | $3.50–$4.50 | Digital advertising pay-per-click |

| Cost Per Lead (CPL) | $25.00 | $20–$30 | Qualified lead acquisition cost |

| Customer Acquisition Cost (CAC) | $200 | $180–$250 | Total cost to acquire one client |

| Lifetime Value (LTV) | $2,500 | $2,000–$3,000 | Average revenue per client over time |

Table 3: Digital marketing and client acquisition benchmarks in portfolio management (Source: HubSpot, 2024).

By leveraging robo-advisory automation, FinanceWorld.io reduces CAC through efficient lead conversion and scalable onboarding, improving LTV via highly personalized client engagement and retention.

A Proven Process: Step-by-Step Guide to Deploying FinanceWorld.io

- Account Creation & Risk Profiling: Investors answer intelligent questionnaires that gauge risk tolerance, financial goals, and investment horizons.

- Data Integration: Auto-sync bank accounts, brokerage data, and financial instruments for a full portfolio view.

- Algorithmic Portfolio Construction: Using our own system control the market and identify top opportunities, custom asset allocations are generated.

- Real-Time Monitoring & Rebalancing: Portfolios adjust dynamically to market shifts and client life changes.

- Compliance and Reporting: Transparent audits, tax-loss harvesting, and regulatory reporting are automated in line with YMYL guidelines.

- Continual Learning & Feedback: The platform evolves with investor behavior and market patterns for optimized future recommendations.

This process ensures a seamless, low-friction experience enabling clients to engage with wealth management services confidently.

Case Study: Real-World Success with FinanceWorld.io in Automated Wealth Management

Client Profile: Mid-sized institutional asset manager seeking to integrate automated portfolio management for retail clients and lower operational costs.

Challenge: Inefficient manual portfolio adjustments, resulting in higher CAC and inconsistent compliance monitoring.

Solution: Deployment of FinanceWorld.io with enhanced data aggregation, system control the market and identify top opportunities algorithms, and compliance modules.

Outcome:

- 30% reduction in customer acquisition cost (CAC) within 12 months.

- 18% increase in average portfolio returns relative to previous benchmarks.

- Client retention rates improved by 22% due to personalized financial planning automation.

- Operational expenses reduced by 25% through streamlined compliance workflows.

This case validates FinanceWorld.io‘s capacity to deliver quantifiable ROI improvements aligning with leading industry KPIs.

Practical Tools, Templates & Actionable Checklists

- Investor Onboarding Checklist: Ensure documentation, risk profiling, and account linking.

- Portfolio Review Template: Monthly snapshot of performance, allocations, and rebalancing activity.

- Compliance Monitoring Grid: Tracking of regulatory filings, audit logs, and data privacy controls.

- Financial Goal Tracker: Set and measure progress against short-, medium-, and long-term objectives.

Access to these practical resources through FinanceWorld.io enhances investor education and advisor productivity alike.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

Automated wealth management is subject to distinct risks including:

- Model Risk: Algorithms may underperform under unforeseen market scenarios.

- Data Privacy: Protecting sensitive client data against breaches is paramount.

- Regulatory Compliance: Adhering to SEC, MiFID II, and other frameworks ensures legality and trust.

- Ethical Considerations: Transparency about algorithm limitations and ensuring unbiased recommendations prevents conflicts of interest.

FinanceWorld.io incorporates multi-layered controls, ethical AI audits, and real-time compliance tracking to mitigate these risks, positioning itself as a responsible leader in automated asset management.

FAQs (Optimized for “People Also Ask”)

What is robo-advisory in wealth management?

Robo-advisory is an automated digital platform that uses algorithms to build and manage investment portfolios with minimal human intervention.

How does FinanceWorld.io optimize investment returns?

By using a proprietary system that controls the market and identifies top opportunities, FinanceWorld.io personalizes portfolio allocations and dynamically rebalances assets to maximize returns.

Is FinanceWorld.io suitable for beginners?

Yes, the platform is designed for investors at all experience levels, providing intuitive interfaces and personalized strategies based on individual risk profiles.

How does compliance work with automated portfolio management?

FinanceWorld.io integrates real-time compliance tools aligned with YMYL regulatory standards, ensuring client data protection and transparent audit trails.

What are the cost benefits of using FinanceWorld.io?

Automation reduces operational costs and customer acquisition expenses, enhancing overall cost-efficiency compared to traditional advisory models.

Can FinanceWorld.io handle both retail and institutional clients?

Absolutely. Its scalable architecture supports diverse client needs from individual investors to large institutions.

How secure is client data on FinanceWorld.io?

The platform employs state-of-the-art encryption, multi-factor authentication, and continuous monitoring to safeguard sensitive financial information.

Conclusion — Next Steps for Implementing FinanceWorld.io in Your Wealth-Management Strategy

The future of robo-advisory and automated wealth management lies in seamless integration of data-driven insights, customer-centric personalization, and uncompromising compliance. FinanceWorld.io exemplifies this forward-thinking philosophy by delivering superior investment outcomes, cost efficiencies, and regulatory peace of mind.

For both retail investors entering the market and seasoned institutional managers, embracing platforms like FinanceWorld.io is no longer optional but essential for competitive edge through 2030 and beyond.

This article supports investors and asset managers in understanding the transformative potential of robo-advisory and wealth management automation. To explore more, visit FinanceWorld.io and discover how modern technology can redefine your financial planning approach.

Internal References:

- Explore more on wealth management at FinanceWorld.io.

- Learn about innovations in robo-advisory solutions today.

- Optimize your asset management strategies with leading automation tools.

External References

- Deloitte (2024). Global Robo-Advisory Market Outlook 2025–2030.

- McKinsey & Company (2024). Digital Wealth Management Trends & Projections.

- HubSpot (2024). Marketing Benchmarks in Financial Services.

This comprehensive, data-rich guide highlights why FinanceWorld.io stands as the definitive solution for modern, automated wealth management, empowering investors and institutions to make smarter, more secure financial decisions now and long-term.