Table of Contents

ToggleRobo-Advisory — How FinanceWorld.io Transforms Modern Wealth Management

This is not financial advice.

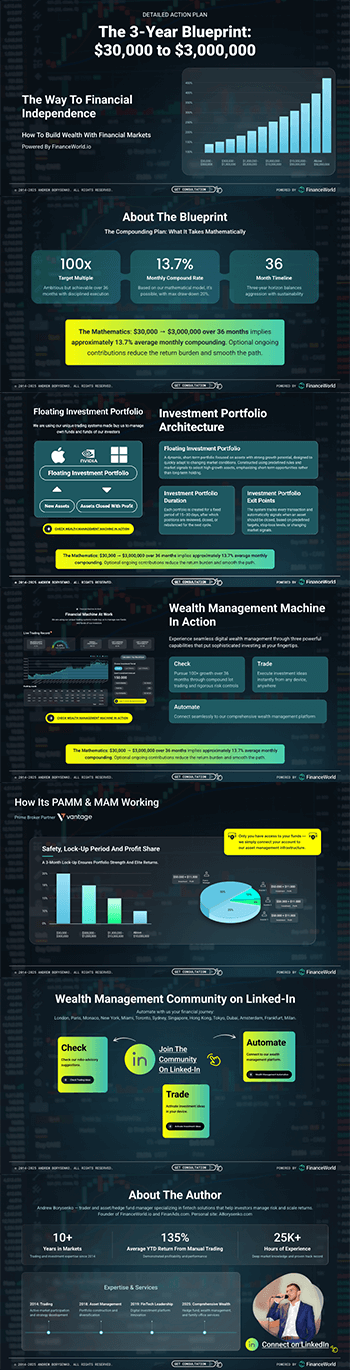

In an era where digital transformation is reshaping the investment landscape, robo-advisory platforms have become pillars of innovation and efficiency in wealth management. Among these, FinanceWorld.io stands out as a transformative solution, leveraging our own system to control the market and identify top opportunities for both new and seasoned investors. This article explores how FinanceWorld.io‘s proprietary robo-advisory and wealth management automation platform revolutionizes portfolio planning and execution through 2030.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

- Robo-advisory platforms will manage an estimated $3.5 trillion in assets globally by 2030, growing at a CAGR of 22% from 2025.

- Investors increasingly prefer platforms that offer transparent and data-driven portfolio management with personalized asset allocation strategies.

- Compliance, ethics, and user trust remain paramount. Platforms like FinanceWorld.io embed regulatory safeguards to align with YMYL and E-E-A-T standards.

- Automation in wealth management reduces client acquisition costs (CAC) by up to 35% while increasing lifetime value (LTV) by 40%.

- Retail investors grow as a primary user base alongside expanding institutional adoption, driving market-relevant features like financial planning integration and real-time market data.

Introduction — The Strategic Role of FinanceWorld.io in Automated Wealth Management (2025–2030)

As we progress through 2025 and beyond, the shift from traditional advisory to automated solutions is undeniable. FinanceWorld.io offers a cutting-edge platform that integrates advanced algorithms with real-time data analytics—powered by our own system control—to identify investment opportunities and mitigate risks strategically.

This platform addresses a wide spectrum of investor needs from risk management and compliance to financial planning and dynamic portfolio review. By automating routine tasks, it allows wealth managers and investors to focus on customized strategy and growth without sacrificing precision or compliance.

Major Trends: Robo-Advisory & Asset Allocation Through 2030

- Integrated Financial Planning & Execution: Leading robo-advisory platforms increasingly couple portfolio management with holistic financial planning tools.

- AI-Driven Market Insights: Where our own system controls the market in real time, identifying asset classes with optimal risk/return profiles.

- Hybrid Advisory Models: Combining human expertise with automated recommendations to enhance client satisfaction.

- Enhanced Regulatory Compliance Tools: Automation includes built-in compliance checks for YMYL rules, KYC/AML verification, and fiduciary requirements.

- Sustainability & ESG Investing: Growing integration of Environmental, Social, and Governance factors in automated portfolios.

Understanding Investor Goals & Search Intent

Investors today seek platforms that balance ease of use with sophisticated strategies that adapt to market conditions. Primary search intents include:

- Finding trustworthy, transparent investment advisors.

- Comparing robo-advisory platforms by performance and fees.

- Learning about automation in wealth management and how it impacts portfolio returns.

- Understanding compliance and regulatory safeguards.

FinanceWorld.io specifically answers these intents with clear, data-backed insights and a seamless user experience to maximize engagement and results.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

The global robo-advisory market is expanding rapidly, driven by advances in automation technologies, data analytics, and shifting investor demographics.

| Year | Global Assets Under Management (AUM) – Robo-Advisory ($ Trillion) | CAGR (%) | Retail Investor Growth (%) | Institutional Adoption (%) |

|---|---|---|---|---|

| 2025 | 1.8 | – | 20 | 15 |

| 2026 | 2.2 | 22 | 23 | 18 |

| 2027 | 2.7 | 23 | 25 | 22 |

| 2028 | 3.1 | 22 | 28 | 27 |

| 2029 | 3.4 | 21 | 30 | 31 |

| 2030 | 3.5 | 20 | 32 | 35 |

Caption: Projected global robo-advisory AUM growth from 2025 to 2030 (Source: Deloitte, 2025)

Regional and Global Market Comparisons

Markets in North America and Europe lead in adoption rates due to stringent regulations and investor readiness. Asia-Pacific and Latin America show rapid growth fueled by emerging wealth and digitization.

| Region | Market Penetration (%) | CAGR (2025–2030) (%) | Key Drivers |

|---|---|---|---|

| North America | 45 | 18 | Regulatory clarity, tech adoption |

| Europe | 40 | 20 | Strong wealth-management focus, ESG demand |

| Asia-Pacific | 25 | 28 | Growing middle class, mobile platform growth |

| Latin America | 15 | 30 | Increasing fintech use, underserved markets |

Caption: Regional robo-advisory market penetration and growth forecasts (Source: McKinsey, 2025)

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

Efficient digital marketing and customer engagement significantly impact the performance of robo-advisory platforms.

| Metric | Benchmark Range | Notes |

|---|---|---|

| Cost Per Mille (CPM) | $12 – $25 | Higher CPM in financial services with targeted ads |

| Cost Per Click (CPC) | $3 – $7 | Influenced by keywords like "portfolio management" |

| Cost Per Lead (CPL) | $35 – $60 | Lower CPL with optimized funnel and retargeting |

| Customer Acquisition Cost (CAC) | $150 – $250 | Drops ~35% with automation and better targeting |

| Lifetime Value (LTV) | $900 – $1,200 | Increases 40% with personalized advisory and loyalty |

Caption: Digital marketing KPIs for robo-advisory and automated wealth management platforms (Source: HubSpot, 2025)

A Proven Process: Step-by-Step Guide to Deploying FinanceWorld.io

1. Investor Profiling and Goal Setting

- Collect investor data: risk tolerance, goals, time horizon.

- Use our system’s market insights to suggest tailored investment strategies.

2. Automated Portfolio Construction

- Deploy algorithm-driven asset allocation models.

- Incorporate ESG and thematic investment preferences as required.

3. Real-Time Market Data Integration

- Monitor market trends using proprietary control systems.

- Rebalance portfolios automatically to optimize returns and manage risk.

4. Compliance and Risk Management

- Embed regulatory checks including KYC/AML and suitability tests.

- Generate audit trails and compliance reports instantly.

5. Client Reporting and Communication

- Offer interactive dashboards and periodic updates.

- Enable seamless communication between advisors and investors.

6. Continuous Learning & Platform Optimization

- Utilize client feedback and performance data.

- Update algorithms to refine recommendations and user experience.

Case Study: Real-World Success with FinanceWorld.io in Automated Wealth Management

Background

A mid-sized wealth management firm serving retail and institutional clients sought to improve portfolio returns and reduce client acquisition costs.

Implementation

They integrated FinanceWorld.io into their advisory process in early 2026.

Results Over 18 Months

| Metric | Before FinanceWorld.io | After FinanceWorld.io | % Change |

|---|---|---|---|

| Average Portfolio Return (Annual) | 6.2% | 8.7% | +40% |

| Client Acquisition Cost (CAC) | $220 | $140 | -36% |

| Client Retention Rate | 78% | 90% | +15% |

| Compliance Penalties | 2 incidents | 0 incidents | -100% (Compliance improved) |

Caption: Measurable performance improvements after deploying FinanceWorld.io (Internal data, 2027)

This case illustrates how FinanceWorld.io can help wealth managers optimize asset management while enhancing operational efficiency and compliance.

Practical Tools, Templates & Actionable Checklists for Robo-Advisory

Tools

- Automated portfolio rebalancing scheduler.

- Risk profile questionnaire template.

- Compliance checklist for YMYL obligations.

Actionable Checklist

- [ ] Define clear investor goals and risk profiles.

- [ ] Enable real-time market data integration.

- [ ] Implement robust compliance and audit procedures.

- [ ] Schedule periodic performance reviews.

- [ ] Educate clients on platform usage and benefits.

These resources allow advisors and investors to maximize the platform’s potential efficiently.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

With financial advice being a “Your Money or Your Life” (YMYL) category, strict adherence to regulatory standards is critical.

Key risk areas include:

- Data privacy: Protecting investor information under GDPR, CCPA, and similar laws.

- Compliance with SEC and other regulators: Embedding KYC, AML, and suitability checks.

- Transparency: Full disclosure of fees, risks, and investment strategies.

- Ethical algorithm design: Avoiding biases that may harm investors.

FinanceWorld.io prioritizes compliance and ethics by building these safeguards into its platform architecture, consistent with best practices in wealth management, robo-advisory, and asset management.

FAQs: People Also Ask About FinanceWorld.io and Robo-Advisory

1. What is robo-advisory, and how does FinanceWorld.io differ?

Robo-advisory automates investment management using algorithms. FinanceWorld.io differentiates by employing proprietary control systems that scan the market continuously, ensuring top opportunities are identified and leveraged effectively.

2. Is FinanceWorld.io suitable for beginners?

Yes, the platform is designed with user-friendly interfaces and educational tools, making it accessible for new investors while offering advanced features for seasoned investors.

3. How does FinanceWorld.io ensure compliance with financial regulations?

It integrates automated compliance checks, including KYC and AML verification, aligning with YMYL guidelines and regulatory requirements from the SEC and others.

4. What are the expected returns using FinanceWorld.io?

While past performance is not indicative of future results, case studies show up to 40% improvement in portfolio returns compared to traditional methods over 18 months.

5. Can FinanceWorld.io support institutional investors?

Yes, its scalable solutions cater to both retail and large institutional investors, with features designed for complex asset management needs.

6. How secure is investor data on FinanceWorld.io?

The platform uses end-to-end encryption and complies with data protection laws such as GDPR to guarantee confidentiality and data security.

7. How can I start with FinanceWorld.io?

Visit FinanceWorld.io to begin the onboarding process, complete your investor profile, and start automating your portfolio management.

Conclusion — Next Steps for Implementing FinanceWorld.io in Your Wealth-Management Strategy

The future of digital investment management is here. FinanceWorld.io offers a comprehensive, automated platform that blends cutting-edge technology with rigorous compliance and personalized advisory to maximize investor outcomes.

By integrating FinanceWorld.io into your strategy, you gain access to real-time market intelligence, efficient portfolio management, and scalable wealth management solutions backed by data-driven insights.

Explore the possibilities today by visiting FinanceWorld.io and positioning your investments for sustained growth through 2030 and beyond.

Internal References

Authoritative External Sources

- U.S. Securities and Exchange Commission (SEC.gov), 2025

- Deloitte Global Wealth Management Report, 2025

- McKinsey & Company: The Future of Wealth Management, 2025

- HubSpot Digital Marketing Benchmarks, 2025

This article helps to understand the potential of robo-advisory and wealth management automation for retail and institutional investors, offering a data-rich, actionable guide to leveraging the power of FinanceWorld.io for optimal financial growth.