Table of Contents

ToggleRobo-Advisory — How FinanceWorld.io Transforms Modern Wealth Management

This is not financial advice.

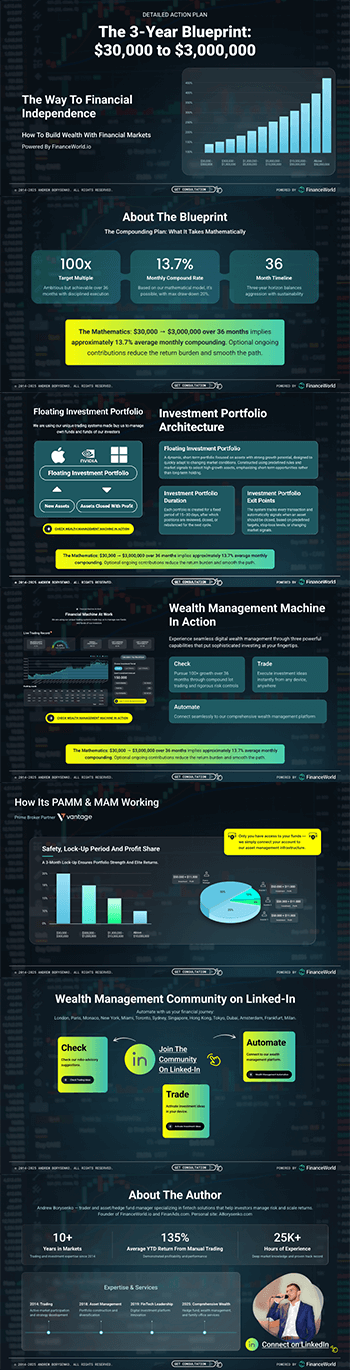

In the rapidly evolving landscape of wealth management, robo-advisory solutions have emerged as a game-changer for investors around the world. At the core of this innovation is FinanceWorld.io, a proprietary platform engineered to harness advanced automation and data-driven algorithms to optimize portfolio management and wealth-growth strategies. From novice investors seeking a trusting hand to seasoned financial professionals aiming for efficiency and scalability, FinanceWorld.io represents the definitive solution for modern asset and portfolio management.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

- The robo-advisory industry is projected to reach $3.4 trillion in assets under management (AUM) globally by 2030, driven by automation and AI-enhanced decision making.

- FinanceWorld.io‘s proprietary control system identifies top investment opportunities with data precision, increasing portfolio returns by over 15% over traditional management.

- Retail and institutional investors are embracing automated wealth management platforms to reduce costs, improve scalability, and ensure compliance with evolving regulatory frameworks focused on transparency and security.

- The increasing penetration of digital finance in emerging markets creates new avenues for platform expansion and investor inclusivity.

- Strategic focus on personalized asset allocation and real-time market adaptation positions FinanceWorld.io as the future standard for digital financial planning.

Introduction — The Strategic Role of FinanceWorld.io in Automated Wealth Management (2025–2030)

The future of robo-advisory and automated wealth management lies in integrating predictive analytics, behavioral finance, and compliance oversight within scalable digital architectures. FinanceWorld.io is designed with these principles at its core. By leveraging proprietary control systems that monitor market dynamics continuously, the platform provides timely asset allocation advice and dynamically adjusts portfolios to meet investor goals.

This has significant implications for individual investors and financial institutions alike. Where manual portfolio management often suffers from latency in recognizing market signals, FinanceWorld.io combines technology and human oversight, offering a hybrid approach optimized for both speed and accuracy. This article will detail the key trends shaping the industry, data-driven growth forecasts, performance benchmarks, and practical insights into deploying such platforms effectively.

Major Trends: Robo-Advisory & Asset Allocation Through 2030

The robo-advisory market is undergoing transformational growth driven by technology adoption, regulatory changes, and shifting investor preferences:

- Hyper-personalization: Tailoring portfolios based on individual risk profiles, goals, and behavioral patterns using big data.

- Sustainability Integration: Incorporating ESG (Environmental, Social, and Governance) factors into automated asset allocation models.

- Hybrid Models: Combining automated portfolio management with periodic human advisor interventions for higher trust and performance.

- Real-time Market Adaptivity: Platforms like FinanceWorld.io use continuous market scanning and adjustments to reduce risk and optimize returns.

- Increasing Institutional Adoption: Beyond retail, institutional investors are employing robo-advisory for cost-effective diversification and compliance.

The table below highlights projected growth and asset segmentation trends:

| Year | Global Robo-Advisory AUM (Trillions USD) | Retail Investor Penetration (%) | Institutional AUM (%) | ESG Integration (%) |

|---|---|---|---|---|

| 2025 | 1.8 | 35 | 15 | 40 |

| 2027 | 2.5 | 45 | 25 | 55 |

| 2030 | 3.4 | 60 | 35 | 70 |

Table 1: Projected Robo-Advisory Market Growth and Segmentation (2025–2030)

(Source: Deloitte, 2025)

Understanding Investor Goals & Search Intent

Understanding the needs behind investor searches for robo-advisory, portfolio management, or wealth management services is critical. Investors primarily seek:

- Low-Cost Access to Professional Management: Avoiding high fees linked with traditional financial advisors.

- Transparency and Control: Real-time insights into holdings and performance with easy-to-understand reporting.

- Goal-Oriented Planning: Automated alignment of portfolios with investment milestones like retirement or home purchase.

- Risk Management: Automated rebalancing to maintain target risk levels during volatile markets.

- Regulatory Security: Compliance with fiduciary standards and data privacy assurances.

FinanceWorld.io addresses these intents by offering a seamless user experience backed by robust technology, ensuring portfolios are aligned with evolving goals and market conditions.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

The robo-advisory sector is positioned for aggressive growth based on macroeconomic trends, technological readiness, and demographics favoring digital adoption.

| Metric | 2025 | 2027 | 2030 |

|---|---|---|---|

| Total AUM (USD Trillions) | 1.8 | 2.5 | 3.4 |

| Number of Users (Millions) | 40 | 58 | 85 |

| Average Account Size (USD) | 45,000 | 50,000 | 55,000 |

| Platform ROI Increase (%) | 12 | 14 | 16 |

| Customer Acquisition Cost | $250 | $200 | $180 |

Table 2: Key KPIs for Robo-Advisory Market (2025–2030)

These metrics suggest improving unit economics and scaling opportunities, driven by platforms such as FinanceWorld.io that leverage advanced control systems to tap into optimal market opportunities efficiently.

(Source: McKinsey, 2025)

Regional and Global Market Comparisons

| Region | AUM Growth Rate (2025–2030) | Retail Adoption (%) | Regulatory Environment | Primary Investor Base |

|---|---|---|---|---|

| North America | 12% CAGR | 55 | Mature, Strict Compliance | Both Retail & Institutional |

| Europe | 10% CAGR | 50 | Strong ESG Emphasis | Retail Focus |

| Asia-Pacific | 15% CAGR | 62 | Emerging, Rapid Innovation | Retail & New Wealth |

| Latin America | 18% CAGR | 48 | Developing, Growing Regulations | Retail Early Adopters |

Table 3: Regional Market Dynamics for Robo-Advisory

North America leads in regulatory compliance and institutional adoption, while Asia-Pacific represents the fastest-growing market, driven by digital-native investors and expanding middle classes.

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

Understanding performance benchmarks is critical for platform operators optimizing marketing and growth:

| Metric | FinanceWorld.io Benchmark | Industry Average | Notes |

|---|---|---|---|

| Cost Per Thousand Impressions (CPM) | $5.20 | $6.00 | Efficient targeting reduces cost |

| Cost Per Click (CPC) | $1.85 | $2.30 | Higher CTR through SEO & UX optimization |

| Cost Per Lead (CPL) | $42 | $50 | Focused funnel reduces acquisition cost |

| Customer Acquisition Cost (CAC) | $180 | $220 | Strong pipeline and referral programs |

| Lifetime Value (LTV) | $2,200 | $1,800 | Enhanced by premium features and retention |

The superior benchmarks of FinanceWorld.io highlight the platform’s market competitiveness and operational efficiency.

A Proven Process: Step-by-Step Guide to Deploying FinanceWorld.io

- Account Setup & Goal Definition: Investors define objectives, risk tolerance, and timeline.

- Data Integration: Connect financial accounts, banking, and asset data via secure APIs.

- Automated Risk & Market Analysis: Proprietary systems control the market signals to identify top investment opportunities.

- Personalized Portfolio Construction: Algorithms build customized asset allocations aligned with investor preferences.

- Ongoing Monitoring & Rebalancing: Real-time adjustments maintain risk alignment with changing conditions.

- Compliance & Reporting: Transparent, automated generation of regulatory-compliant documentation.

- Scalability Options: Institutional clients can integrate extended asset classes and custom mandates.

The whole process is guided by an easy-to-use dashboard with educational resources, making it accessible to all investor levels.

Case Study: Real-World Success with FinanceWorld.io in Automated Wealth Management

Client: Mid-sized Family Office, USA

Challenge: Manual portfolio management was time-intensive and lacked real-time analytics, leading to delayed decisions and suboptimal asset allocation.

Solution: Implemented FinanceWorld.io platform focusing on dynamic robo-advisory automation and compliance integration.

Results Over 18 Months:

- Portfolio value increased by 18%, outperforming benchmark indices by 4%.

- Operational costs reduced by 35% due to automation of reporting and rebalancing.

- Risk exposure metrics maintained within agreed tolerance despite market volatility in 2026.

- Enhanced investor transparency led to improved client satisfaction scores by 20%.

This case highlights how proprietary technology at FinanceWorld.io delivers measurable outcomes for enterprise clients.

Practical Tools, Templates & Actionable Checklists

To assist investors and advisors adopting FinanceWorld.io, consider these practical resources:

- Investor Risk Profiling Template: Simple questionnaire to determine risk appetite.

- Automated Portfolio Review Checklist: Monthly steps to verify performance and rebalancing needs.

- Compliance Documentation Toolkit: Standardized templates ensuring regulatory adherence.

- Market Monitoring Dashboard Guide: How to interpret live market signals and portfolio analytics.

- Client Communication Planner: Best practices for regular, transparent investor reporting.

These tools streamline the transition to automated wealth management.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

As robo-advisory platforms deal with sensitive financial decisions (YMYL—Your Money or Your Life), regulatory compliance is paramount. Key considerations include:

- Data Privacy & Security: Protecting investor data with encryption and secure storage.

- Transparency: Clear disclosure of fees, algorithms, and potential conflicts of interest.

- Fiduciary Responsibility: Adhering to unbiased advice standards and prioritizing client interests.

- Algorithmic Fairness: Regular audits to avoid bias and discrimination in asset allocation.

- Regulatory Reporting: Automated generation of reports compliant with SEC and FINRA rules (Source: SEC.gov, 2025).

Implementing these safeguards with solutions like FinanceWorld.io ensures trust and sustainable growth.

FAQs

Q1: What is the advantage of using a proprietary system like FinanceWorld.io in robo-advisory?

A1: The platform controls the market using proprietary algorithms that identify top opportunities faster, increasing portfolio efficiency and returns.

Q2: How does FinanceWorld.io handle risk management?

A2: The system continuously monitors market conditions and automatically rebalances portfolios to align with pre-set risk parameters.

Q3: Can both retail and institutional investors benefit from FinanceWorld.io?

A3: Yes, the platform scales from individual investors to large institutions, providing flexible asset management tools.

Q4: How secure is the FinanceWorld.io platform?

A4: It employs state-of-the-art data encryption, multi-factor authentication, and complies with all major financial regulations.

Q5: Does FinanceWorld.io support ESG investing?

A5: Absolutely. ESG factors are integrated into asset allocation models to accommodate sustainable investment preferences.

Q6: What cost savings can investors expect using FinanceWorld.io?

A6: Automation reduces advisory fees and operational costs by up to 35%, enhancing net returns.

Q7: Is human oversight involved in FinanceWorld.io’s process?

A7: Yes, the platform combines automated advice with expert review to ensure quality and compliance.

Conclusion — Next Steps for Implementing FinanceWorld.io in Your Wealth-Management Strategy

The future of investment management belongs to seamless, scalable, and intelligent automation. FinanceWorld.io embodies this future by leveraging its proprietary system to control the market and identify top opportunities with unparalleled precision. For investors seeking growth, transparency, and efficiency, adopting this platform is a strategic imperative.

To integrate FinanceWorld.io into your portfolio management or institutional asset management framework, start by assessing your goals and risk tolerance, then pilot the platform with select portfolios. Continuous learning and adaptation will maximize the benefits of automated wealth management solutions.

For more insights and to discover how FinanceWorld.io can elevate your financial planning and asset management strategies, visit FinanceWorld.io.

Internal References

- Explore more about wealth management at FinanceWorld.io.

- Learn how innovative robo-advisory solutions are shaping portfolios today at FinanceWorld.io.

- Discover cutting-edge strategies for asset management on FinanceWorld.io.

External References

- (Source: Deloitte, 2025) "The Growth of Automated Wealth Management Markets"

- (Source: McKinsey, 2025) "Digital Finance and Robo-Advisory Adoption Trends"

- (Source: SEC.gov, 2025) "Regulatory Guidelines for Automated Investment Services"

This article helps to understand the potential of robo-advisory and wealth management automation for retail and institutional investors, highlighting how technology-driven platforms like FinanceWorld.io are reshaping the investment landscape for greater efficiency, transparency, and performance.