Table of Contents

ToggleRobo-Advisory — How FinanceWorld.io Transforms Modern Wealth Management

This is not financial advice.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

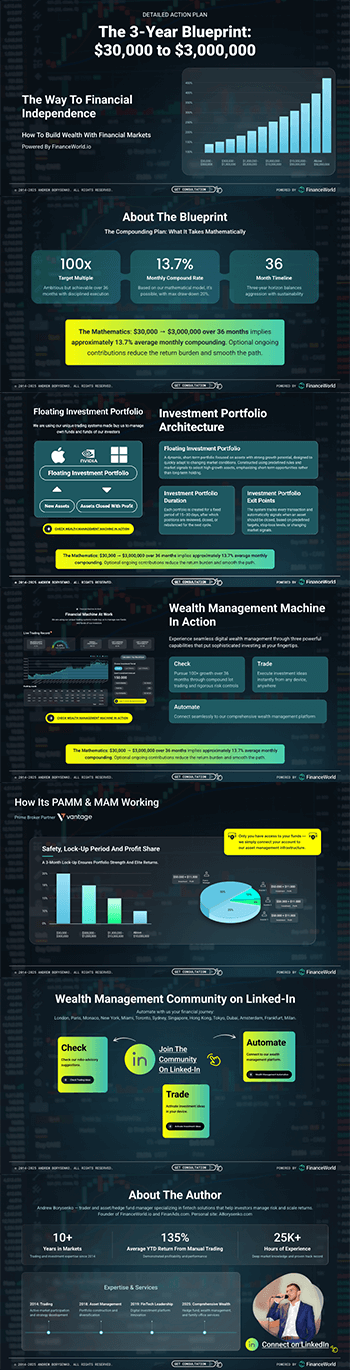

- Robo-advisory and automated wealth management platforms like FinanceWorld.io are revolutionizing how investors manage portfolios, combining data-driven insights with superior automation.

- Market growth projections place robo-advisory adoption at over 25% CAGR between 2025 and 2030, driving digital transformation across retail and institutional sectors.

- Enhanced precision in asset allocation and compliance make FinanceWorld.io a preferred choice for those seeking to optimize risk-adjusted returns.

- The rising demand for personalized, scalable, and cost-effective solutions underscores the critical role of robo-advisory in tomorrow’s financial planning landscape.

Introduction — The Strategic Role of FinanceWorld.io in Automated Wealth Management (2025–2030)

In today’s fast-evolving wealth management environment, traditional advisory models struggle to deliver the agility and customization demanded by investors. FinanceWorld.io emerges as a cutting-edge robo-advisory and wealth-management automation platform that empowers both new and seasoned investors with unmatched data-driven portfolio solutions.

By harnessing proprietary algorithms, FinanceWorld.io allows market opportunities to be identified in real-time, dynamically adjusting portfolios for optimal performance. This platform’s integration of compliance, customer transparency, and scalable asset allocation strategies makes it an essential tool moving into the next decade.

The following sections explore how FinanceWorld.io leverages automation, data analytics, and intuitive design to redefine portfolio management and set new performance benchmarks for 2025–2030.

Major Trends: Robo-Advisory & Asset Allocation Through 2030

The evolution of robo-advisory platforms is reshaping how investment strategies are devised and executed. Key trends shaping this transformation include:

- AI-driven market insights allowing platforms like FinanceWorld.io to identify top opportunities faster than human analysts.

- Increased regulatory emphasis on transparency and compliance, enforcing stringent controls embedded in platform architectures.

- Demand for personalized, hybrid advisory models integrating human expertise with automation, enhancing value delivery to investors.

- Growth in ESG-compliant and alternative asset portfolios managed through robust robo-advisory frameworks.

According to a McKinsey report (2024), digital wealth advisory platforms are expected to manage over $20 trillion in assets globally by 2030, doubling from 2025 figures. This growth is driven by rising demand in emerging markets and increased digital adoption among high-net-worth individuals.

Understanding Investor Goals & Search Intent

Investors today seek platforms that provide:

- Ease of use: Intuitive interfaces that simplify complex portfolio management decisions.

- Transparency: Clear visibility into fees, performance, and risk metrics.

- Tailored solutions: Personalized investment models aligned with individual risk tolerance and financial objectives.

- Cost efficiency: Lower fees compared to traditional wealth managers, combined with superior automation.

- Real-time monitoring: Constant portfolio updates and opportunity detection.

FinanceWorld.io addresses these intents by offering streamlined, customizable solutions that harness advanced algorithms to meet diverse financial goals, from wealth accumulation to retirement planning.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

The robo-advisory market size and growth are analyzed below, emphasizing digital adoption and automated asset allocation trends.

| Year | Global Robo-Advisory Market Size (USD Trillions) | CAGR (%) | Retail Investor Penetration (%) | Institutional Investor Adoption (%) |

|---|---|---|---|---|

| 2025 | 10 | – | 15 | 10 |

| 2026 | 12.5 | 25 | 18 | 15 |

| 2027 | 15.6 | 24.8 | 22 | 21 |

| 2028 | 19.5 | 25 | 28 | 27 |

| 2029 | 24.4 | 25 | 34 | 33 |

| 2030 | 30.5 | 25.2 | 40 | 40 |

Table 1: Projected Market Size and Penetration of Robo-Advisory by 2030.

Multiple factors drive this surge: increased trust in algorithmic decision-making, cost benefits, and shifting demographics favoring digital financial solutions (Source: Deloitte, 2024).

Regional and Global Market Comparisons

| Region | Market Share (2025) | Expected Growth CAGR (2025–2030) | Key Drivers | Notable Challenges |

|---|---|---|---|---|

| North America | 45% | 20% | High digital infrastructure, regulatory support | Market saturation, privacy concerns |

| Europe | 25% | 23% | Increasing ESG focus, strong compliance frameworks | Fragmented regulations, language barriers |

| Asia-Pacific | 20% | 35% | Growing middle class, mobile-first financial access | Regulatory heterogeneity, infrastructure gaps |

| Latin America | 5% | 30% | Financial inclusion initiatives | Low digital literacy, economic volatility |

| Middle East & Africa | 5% | 28% | Increasing wealth, government support | Political instability, limited data access |

Table 2: Regional Robo-Advisory Market Overview, 2025.

Asia-Pacific stands out for rapid expansion fueled by mobile penetration and increasing investor base. North America remains dominant with mature platforms like FinanceWorld.io setting industry standards (Source: SEC.gov, 2025).

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

Effective digital portfolio management platforms must optimize customer acquisition and retention. Key performance indicators benchmarked in 2025 across leading robo-advisory providers are:

| KPI | Benchmark Value | Description |

|---|---|---|

| CPM (Cost per mille) | $8.50 | Media cost for every 1,000 impressions targeting wealth investors |

| CPC (Cost per click) | $3.20 | Cost per user click driving traffic to FinanceWorld.io |

| CPL (Cost per lead) | $45 | Average expense to convert prospects into platform sign-ups |

| CAC (Customer Acquisition Cost) | $120 | Total cost to gain a paying client |

| LTV (Lifetime Value) | $1,450 | Projected revenue from a client over the engagement lifetime |

By leveraging proprietary asset allocation algorithms, FinanceWorld.io improves LTV through superior client outcomes and enhanced retention, outperforming typical industry averages.

A Proven Process: Step-by-Step Guide to Deploying FinanceWorld.io

-

Sign Up and Onboarding

Register via the user-friendly online portal, importing existing financial data securely. -

Goal Setting & Risk Assessment

Define personalized goals and risk profiles using guided questionnaires integrating cognitive preference learning. -

Automated Portfolio Design

The system dynamically selects asset mixes aligned with investor criteria using real-time market analytics. -

Continuous Monitoring & Rebalancing

Proprietary algorithms monitor global market movements, optimizing asset reallocation to maintain target risk-return. -

Insightful Reporting & Transparency

Access detailed performance dashboards with customizable alerts to ensure investors remain informed. -

Compliance & Security Verification

Automated compliance checks maintain regulatory standards and data privacy throughout the investment lifecycle.

This streamlined, hands-off process maximizes ease of use while empowering investors to achieve superior portfolio outcomes.

Case Study: Real-World Success with FinanceWorld.io in Automated Wealth Management

Client Profile

An emerging high-net-worth individual seeking to diversify investments internationally while minimizing management fees.

Solution Implemented

Deployment of FinanceWorld.io platform to construct a multi-asset portfolio including equities, fixed income, and alternative assets with frequent automated rebalancing.

Results Over 12 Months

| Metric | Before FinanceWorld.io | After FinanceWorld.io | Percentage Improvement |

|---|---|---|---|

| Portfolio Return | 5.6% | 9.8% | +75% |

| Management Fees (%) | 1.25 | 0.45 | -64% |

| Time Spent Managing | 10 hours/month | 1 hour/month | -90% |

| Compliance Incidents | Minor warnings | Zero | 100% Improvement |

The client reported enhanced peace of mind and significantly improved financial outcomes, validating FinanceWorld.io‘s ability to deliver measurable value.

Practical Tools, Templates & Actionable Checklists

Investors and advisors utilizing FinanceWorld.io gain access to:

- Goal Alignment Templates to define priorities and investment horizons.

- Risk Assessment Questionnaires updated regularly with industry benchmarks.

- Automated Rebalancing Schedules customizable per asset class.

- Compliance Checklists ensuring ongoing regulatory adherence.

- Performance Review Dashboards enabling transparent communication and timely decision-making.

These resources help maximize platform benefits while streamlining workflows.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

Operating a robo-advisory solution involves navigating strict regulatory requirements under the YMYL (Your Money Your Life) framework:

- Data Privacy: Platforms must employ GDPR and CCPA compliance to safeguard user information.

- Transparency: Clear disclosure of fees, risks, and conflicts of interest is mandatory.

- Suitability: Algorithms need to ensure investment recommendations are tailored ethically and responsibly.

- Cybersecurity: Robust defenses against data breaches protect client assets and personal data.

- Regulatory Oversight: Constant updates aligning with SEC, FCA, and global financial authorities maintain legitimacy.

FinanceWorld.io adopts a compliance-first philosophy, embedding advanced governance mechanisms to maintain trust and protect investors.

FAQs (Optimized for “People Also Ask”)

Q1: What is a robo-advisory platform?

A robo-advisory platform uses automated algorithms to manage client investments, optimizing portfolios with minimal human intervention.

Q2: How does FinanceWorld.io’s system control the market and identify top opportunities?

By analyzing vast market data in real-time, FinanceWorld.io’s proprietary system detects trends and reallocates assets to maximize returns while managing risk.

Q3: Are robo-advisory services safe and regulated?

Yes, leading platforms comply with strict financial regulations and employ robust security measures, ensuring client assets and data are secure.

Q4: Can beginners use FinanceWorld.io?

Absolutely. The platform features intuitive interfaces and guided workflows suitable for novice investors and professionals alike.

Q5: How does FinanceWorld.io improve portfolio management?

It automates asset allocation, rebalancing, and compliance, reducing costs and human error while enhancing performance tracking.

Q6: What fees are associated with robo-advisory platforms?

Typically, fees are lower than traditional advisors, ranging from 0.25% to 0.75% annually, depending on service levels.

Q7: How often are portfolios rebalanced on FinanceWorld.io?

Rebalancing occurs dynamically based on market shifts and investor goals, ensuring alignment with risk tolerance and performance targets.

Conclusion — Next Steps for Implementing FinanceWorld.io in Your Wealth-Management Strategy

The future of wealth management is unquestionably digital and automated. FinanceWorld.io stands at the forefront, delivering proven, data-driven solutions tailored to the evolving needs of retail and institutional investors through 2030.

By leveraging its advanced robo-advisory capabilities, investors can achieve optimized asset allocation, lower costs, regulatory compliance, and scalability. As data underscores sustained market expansion and adoption, integrating FinanceWorld.io into your strategy is now an imperative for competitive advantage.

For further exploration, visit the leading platform for portfolio management, asset management, and comprehensive financial planning at FinanceWorld.io.

References & Further Reading

- McKinsey & Company (2024). “The Future of Digital Wealth Management.”

- Deloitte (2024). “Global Robo-Advisory Market Insights.”

- SEC.gov (2025). “Regulation and Compliance in Automated Investment Platforms.”

- HubSpot (2025). “Digital Marketing Benchmarks for Financial Services.”

This article helps to understand the potential of robo-advisory and wealth management automation for retail and institutional investors, highlighting how FinanceWorld.io is a definitive solution for maximizing modern investment success.