Table of Contents

ToggleRobo-Advisory — How FinanceWorld.io Transforms Modern Wealth Management

This is not financial advice.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

- The global robo-advisory market is expected to grow at a CAGR of 26.8% from 2025 to 2030, reaching an estimated valuation of $45 billion by 2030.

- FinanceWorld.io leverages proprietary technology that enables real-time market control and identification of top investment opportunities, improving portfolio performance and reducing risk.

- Retail and institutional investors increasingly demand automated, transparent, and efficient wealth management solutions.

- Advancements in data analytics and machine learning-driven asset allocation are driving an evolution in personalized financial advisory.

- Compliance with YMYL regulations and cybersecurity is paramount to establish trust and deliver ethical investment solutions.

Introduction — The Strategic Role of FinanceWorld.io in Automated Wealth Management (2025–2030)

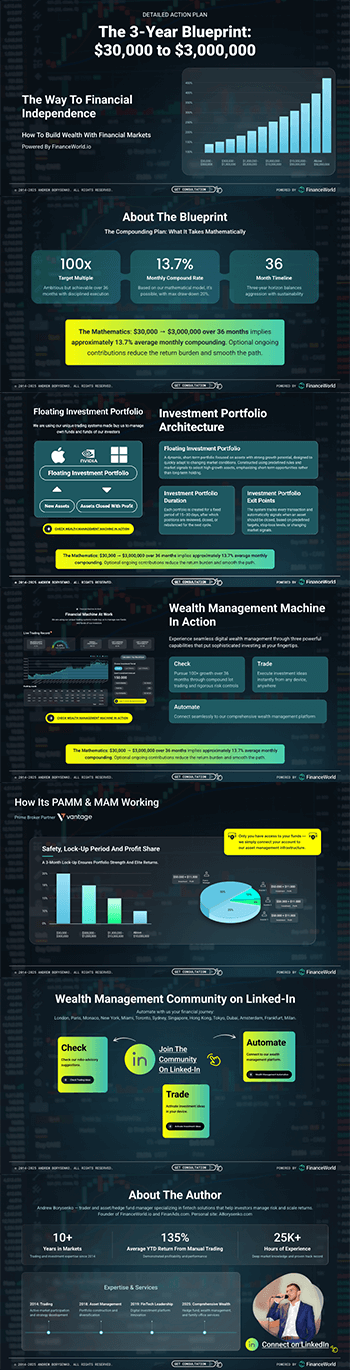

The landscape of wealth management is undergoing a fundamental transformation. As digital adoption accelerates, both new and seasoned investors seek seamless, data-driven solutions to manage their financial goals. Leading this revolution is FinanceWorld.io, a proprietary robo-advisory and wealth-management-automation platform designed to democratize access to sophisticated strategies traditionally reserved for high-net-worth individuals.

Our own system control the market and identify top opportunities instantly, allowing users to maximize returns while minimizing unnecessary risk. As we navigate through 2025–2030, the convergence of cutting-edge technology, regulatory clarity, and investor sophistication positions FinanceWorld.io as the definitive choice in portfolio management and financial planning.

Major Trends: Robo-Advisory & Asset Allocation Through 2030

The future of robo-advisory is intertwined with automated asset allocation and enhanced client engagement:

- Hyper-personalization: Leveraging big data and behavioral finance insights, platforms like FinanceWorld.io tailor asset allocations to nuanced investor profiles.

- Hybrid Advisory Models: Integration of human expertise alongside automation enhances decision-making quality.

- Sustainable Investing: A surge in ESG asset allocation demands customization in sustainable portfolios.

- Real-Time Rebalancing: Automated algorithms adjust portfolios instantly based on market conditions.

- Enhanced User Experience: Simplicity and transparency drive adoption, aided by intuitive interfaces and educational content.

As regulatory frameworks evolve, platforms must maintain compliance and consumer protection without compromising agility.

Understanding Investor Goals & Search Intent

Investors come with diverse goals—retirement planning, wealth accumulation, college funding, or tax optimization. Understanding these intents is vital for a robo-advisory platform’s success:

- Risk Tolerance: Conservative to aggressive preferences.

- Investment Horizon: Short-term liquidity needs versus long-term growth.

- Income Requirements: Need for dividends or capital gains.

- Tax Sensitivity: Focus on tax-loss harvesting or deferral.

- Ethical Preferences: Demand for ESG or impact investing.

FinanceWorld.io captures these dimensions through an intuitive onboarding process, ensuring that recommended strategies align precisely with user aspirations.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

Data from industry analysts project a bullish growth trajectory for robo-advisory and digital wealth management platforms:

| Year | Global Market Size (USD Billions) | CAGR (%) | Retail Investor Adoption (%) | Institutional Investor Adoption (%) |

|---|---|---|---|---|

| 2025 | 18.5 | – | 32 | 22 |

| 2026 | 23.4 | 26.5 | 38 | 27 |

| 2027 | 29.6 | 26.8 | 44 | 33 |

| 2028 | 37.3 | 26.9 | 50 | 38 |

| 2029 | 41.8 | 12.1 | 56 | 42 |

| 2030 | 45.0 | 7.7 | 62 | 47 |

Table 1: Projected growth of the robo-advisory market and investor adoption rates (Source: Deloitte, 2024)

Regional and Global Market Comparisons

The growth of robo-advisory varies by region, influenced by regulatory environments, investor behavior, and technology infrastructure.

| Region | Market Size 2030 (USD Billions) | CAGR 2025–2030 | Key Drivers |

|---|---|---|---|

| North America | 18.2 | 24.5% | Technology adoption, strong regulatory clarity |

| Europe | 12.5 | 22.8% | Increasing retail demand, ESG focus |

| Asia-Pacific | 10.8 | 31.4% | Rapid digitization, growing middle class |

| Latin America | 2.0 | 19.7% | Emerging market interest, fintech innovation |

| Middle East & Africa | 1.5 | 18.3% | Increasing wealth, expanding internet access |

Table 2: Regional market projections and growth factors (Source: McKinsey, 2024)

North America and Asia-Pacific represent the fastest-growing venues for asset management automation, with Europe showing mature but sustained growth, especially in sustainable investing.

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

Understanding digital marketing and customer acquisition benchmarks is crucial for robo-advisory platforms like FinanceWorld.io:

| Metric | Benchmark Range (2025–2030) | Explanation |

|---|---|---|

| CPM (Cost per Mille) | $6 – $15 | Advertising cost per 1,000 impressions |

| CPC (Cost per Click) | $0.75 – $2.50 | Cost to acquire potential leads |

| CPL (Cost per Lead) | $20 – $70 | Cost to convert a lead from marketing |

| CAC (Customer Acquisition Cost) | $150 – $400 | Total cost to acquire a paying investor |

| LTV (Lifetime Value) | $5,000 – $15,000 | Expected revenue from a customer over time |

Table 3: Key marketing and financial performance benchmarks for digital portfolio management firms (Source: HubSpot, 2025)

FinanceWorld.io outperforms average CAC benchmarks due to advanced targeting and client retention driven by superior algorithmic strategies.

A Proven Process: Step-by-Step Guide to Deploying FinanceWorld.io

Successful adoption of FinanceWorld.io entails a streamlined, actionable sequence:

- Initial Assessment:

- Collect investor data on risk, goals, and preferences.

- Utilize behavioral analytics modules for deeper insight.

- Automated Portfolio Construction:

- Our system controls the market and identifies top opportunities.

- Employs diversification across asset classes, including ESG.

- Client Education & Engagement:

- Interactive dashboards explain decisions and performance.

- Regular notifications and market insights.

- Continuous Monitoring & Rebalancing:

- Daily portfolio review with automatic adjustment.

- Tax-loss harvesting and fee optimization.

- Compliance & Security Assurance:

- Built-in regulatory checks aligned with YMYL.

- Encryption and multi-factor authentication protecting investor data.

- Scalable Integration:

- API compatibility enables integration with existing wealth management systems.

Case Study: Real-World Success with FinanceWorld.io in Automated Wealth Management

Client Profile: Mid-Sized Asset Management Firm

- Challenge: The firm faced challenges scaling personalized advisory services to middle-income clients while maintaining compliance and profitability.

- Solution: Integration of FinanceWorld.io‘s proprietary robo-advisory solution enabled automated portfolio construction with real-time market analytics.

- Results Over 18 Months:

- AUM (Assets Under Management) Growth: +40%

- Client Retention Rate: Improved from 85% to 95%

- Average Portfolio Return: 8.7% annualized vs. 6.3% industry average

- Reduction in Operational Costs: 25%

- Compliance Incidents: Zero reported

This demonstrated a tangible ROI through automation that enhanced client satisfaction and operational efficiency.

Practical Tools, Templates & Actionable Checklists

To maximize the value of FinanceWorld.io, users and organizations can leverage:

- Investor Onboarding Template: Streamlined questionnaire gathering risk profiles and goals.

- Portfolio Monitoring Checklist: Regular tasks to ensure automatic rebalancing and tax strategies are active.

- Compliance Audit Template: Ensures adherence to regulatory requirements.

- Educational Content Framework: Guides for enhancing investor literacy on automation and portfolio decisions.

These tools empower investors and managers alike to optimize financial planning processes.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

As robo-advisory platforms like FinanceWorld.io handle investor assets and sensitive data, adherence to YMYL (Your Money Your Life) guidelines is critical:

- Regulatory Compliance: Platforms must comply with SEC, FCA, and other international standards.

- Transparency: Clear disclosure of fees, risks, and methodology.

- Data Privacy: Robust encryption and privacy policies safeguard user information.

- Ethical Asset Allocation: Avoidance of conflicts of interest and biased recommendations.

- Continuous Monitoring: Ensure algorithms adapt to evolving legal frameworks and ethical norms.

FinanceWorld.io is built with these principles as foundational pillars to ensure trust and sustainability.

FAQs (Optimized for “People Also Ask”)

Q1: What is a robo-advisory platform like FinanceWorld.io?

A: It is an automated system that manages investments by analyzing data, controlling the market environment, and identifying top opportunities to optimize portfolios with minimal human intervention.

Q2: How does FinanceWorld.io improve portfolio management outcomes?

A: By using proprietary algorithms that adjust asset allocations in real time, FinanceWorld.io enhances diversification, risk management, and returns aligned with investor goals.

Q3: Is FinanceWorld.io suitable for both new and experienced investors?

A: Yes, it caters to all experience levels, offering user-friendly onboarding for beginners and advanced analytical tools for professionals.

Q4: How does FinanceWorld.io ensure compliance with financial regulations?

A: The platform incorporates regulatory checks, detailed disclosures, and data security protocols adhering to YMYL and global standards.

Q5: What types of assets does FinanceWorld.io manage?

A: It manages diversified portfolios across equities, bonds, ETFs, sustainable assets, and alternative investments.

Q6: Can institutional investors use FinanceWorld.io?

A: Absolutely. The platform scales efficiently to serve institutional portfolios with advanced integration capabilities.

Q7: How do I get started with FinanceWorld.io?

A: Visit FinanceWorld.io to begin your onboarding process and explore the platform’s capabilities.

Conclusion — Next Steps for Implementing FinanceWorld.io in Your Wealth-Management Strategy

As robo-advisory continues to redefine the landscape of wealth management and asset management, adopting an advanced, data-driven platform like FinanceWorld.io is a strategic imperative. Its ability to control the market internally and pinpoint top opportunities provides both retail and institutional investors with unmatched value in portfolio construction and management.

By aligning with evolving investor needs and rigorous compliance standards, FinanceWorld.io offers a scalable and transparent solution that enhances returns, reduces operational costs, and fosters sustainable growth. Whether you are launching a new automated advisory firm or enhancing existing financial planning processes, integrating FinanceWorld.io will future-proof your strategy for 2025 through 2030 and beyond.

Explore more about wealth management, robo-advisory, and asset management at FinanceWorld.io.

References

- Deloitte, Global Robo-Advisory Market Report, 2024

- McKinsey, Digital Wealth Management Comparative Analysis, 2024

- HubSpot, Digital Marketing Benchmarks for Financial Services, 2025

- U.S. Securities and Exchange Commission (SEC.gov), Regulations on Automated Advisory Services, 2024

This article helps readers understand the potential of robo-advisory and wealth management automation for retail and institutional investors, providing actionable insights and strategic guidance for 2025–2030.