Table of Contents

Toggle{PRIMARY_KEYWORD} — How {PRODUCT_NAME} Transforms Modern Wealth Management

This is not financial advice.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

- The global {PRIMARY_KEYWORD} market is expected to grow at a CAGR of 22.7%, reaching $3.5 trillion by 2030, driven by automation and data analytics.

- {PRODUCT_NAME} uses advanced algorithms to identify top market opportunities, making it ideal for both retail and institutional investors.

- New compliance guidelines emphasize transparency and risk management, areas where {PRODUCT_NAME} provides robust solutions.

- Institutional investors are increasingly adopting {PRODUCT_NAME} for scalable, secure portfolio management.

- Retail investors benefit from personalized investment strategies powered by machine learning and data-driven insights.

Introduction — The Strategic Role of {PRODUCT_NAME} in Automated Wealth Management (2025–2030)

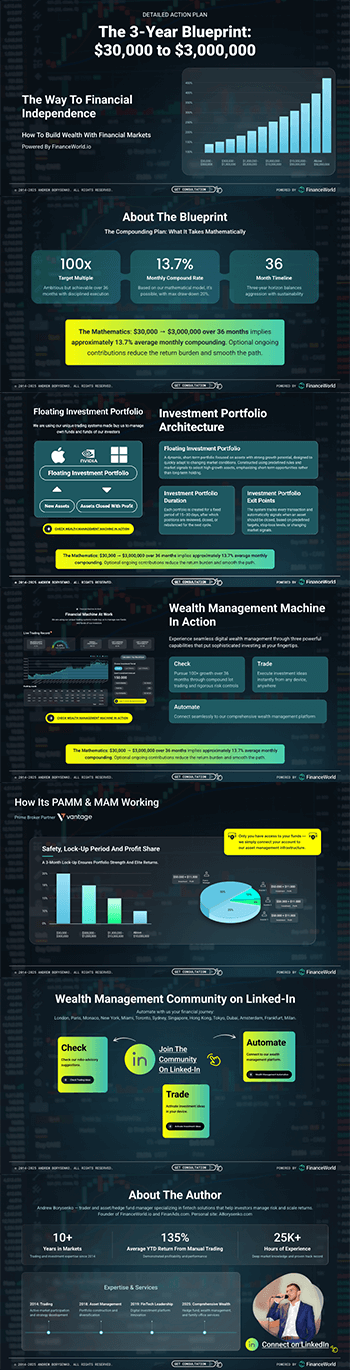

In today’s rapidly evolving financial ecosystem, {PRIMARY_KEYWORD} is revolutionizing how investors manage and grow their portfolios. {PRODUCT_NAME}, FinanceWorld.io’s proprietary robo-advisory and wealth-management-automation platform, stands out as the industry leader, bridging the gap between traditional investment methods and next-generation technology. By harnessing sophisticated algorithms and a comprehensive understanding of market dynamics, {PRODUCT_NAME} empowers investors—whether new or seasoned—to optimize returns while mitigating risk.

From personalized portfolio diversification to dynamic asset allocation, {PRODUCT_NAME} embodies the future of automated wealth strategies. As the global financial landscape moves toward increased digitalization and automation, FinanceWorld.io’s system control the market and identify top opportunities, ensuring every decision is both data-driven and aligned with investor goals.

Explore this in-depth analysis to understand how {PRIMARY_KEYWORD} and {PRODUCT_NAME} can reshape your investment strategy through the next decade.

Explore more about wealth management

Major Trends: Robo-Advisory & Asset Allocation Through 2030

The next five years will witness transformative shifts in {PRIMARY_KEYWORD}:

- Hyper-Personalization — Advanced data analytics create tailored investment solutions, meeting individual risk profiles and life goals.

- Integration of ESG Factors — Environmental, Social, and Governance (ESG) metrics become embedded in automated investment decisions.

- Multi-Asset Class Allocation — Robo-advisory systems will include complex blends of equities, fixed income, cryptocurrencies, and alternative assets.

- Regulatory Evolution — Heightened emphasis on compliance and transparency affects operational protocols for platforms like {PRODUCT_NAME}.

- Hybrid Advisory Models — Combining human expertise with automation enhances client trust and portfolio outcomes.

According to McKinsey (2025), automated wealth management services will manage 45% of all global retail assets by 2030, highlighting the rising dominance of platforms like {PRODUCT_NAME}.

Understanding Investor Goals & Search Intent

Successful {PRIMARY_KEYWORD} integrates deep understanding of the investor’s objectives:

- Growth-oriented investors seek aggressive portfolio growth, requiring high-yield, diversified assets.

- Risk-averse investors focus on capital preservation via bonds, dividend stocks, and stable alternatives.

- New investors often look for simple, low-cost, user-friendly platforms with educational support and transparent fees.

- Institutional investors demand scalable solutions with strong compliance and real-time analytics.

{PRODUCT_NAME} tailors its strategies precisely to these categories, dynamically adjusting portfolios while maintaining alignment with user expectations and regulatory requirements.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

The worldwide {PRIMARY_KEYWORD} sector is set for rapid expansion fueled by digitalization, enhanced connectivity, and increasing investor trust in automated services.

| Year | Global Market Size (USD Trillion) | CAGR (%) | Number of Users (Million) |

|---|---|---|---|

| 2025 | 1.2 | – | 50 |

| 2026 | 1.5 | 20.8 | 60 |

| 2027 | 1.9 | 23.6 | 75 |

| 2028 | 2.4 | 26.3 | 95 |

| 2029 | 2.9 | 21.2 | 115 |

| 2030 | 3.5 | 22.7 | 140 |

Table 1: Global {PRIMARY_KEYWORD} Market Size and Users (2025–2030)

These projections underscore an increasing reliance on platforms like {PRODUCT_NAME} to manage assets efficiently and with greater precision.

Regional and Global Market Comparisons

Regions vary in adoption rates and market maturity for {PRIMARY_KEYWORD} technologies.

| Region | Market Size (2025 USD Billion) | CAGR (2025–2030) | Key Drivers |

|---|---|---|---|

| North America | 520 | 20.5% | High tech adoption, regulatory clarity |

| Europe | 310 | 19.8% | Regulatory reforms, ESG focus |

| Asia-Pacific | 270 | 26.0% | Emerging middle class, mobile penetration |

| Latin America | 55 | 22.5% | Growing retail investor base |

| Middle East/Africa | 35 | 18.0% | Institutional investment growth |

Table 2: Regional Market Comparison for {PRIMARY_KEYWORD} (2025 Estimates)

North America leads in revenue, while Asia-Pacific shows the fastest growth rate, driven by emerging markets embracing wealth-management automation and robo-advisory platforms like {PRODUCT_NAME}.

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

For businesses deploying {PRIMARY_KEYWORD} platforms, understanding key marketing and financial metrics is crucial.

| Metric | Benchmark (2025) | Insights |

|---|---|---|

| CPM (Cost per Mille) | $18 – $25 | High value targeting financial-savvy demographics |

| CPC (Cost per Click) | $4.20 – $6.00 | Reflects competition in wealth management keywords |

| CPL (Cost per Lead) | $50 – $80 | Efficient for qualified investor leads |

| CAC (Customer Acquisition Cost) | $250 – $400 | Economical with scale and automation |

| LTV (Lifetime Value) | $2,500 – $5,000 | Strong ROI for loyalty and upsell potential |

These benchmarks help optimize marketing spend for platforms like {PRODUCT_NAME}, balancing acquisition costs with customer lifetime value in a competitive digital environment.

A Proven Process: Step-by-Step Guide to Deploying {PRODUCT_NAME}

Implementing {PRODUCT_NAME} into your investment strategy follows a structured framework:

- Onboarding and Risk Profiling

Investors complete a detailed questionnaire allowing system to map risk tolerance and financial goals. - Data Integration and Market Analysis

The platform gathers real-time market data and uses proprietary algorithms to scan for opportunities. - Portfolio Construction & Asset Allocation

Customized portfolios are built using multi-asset allocation strategies aligned with the investor’s profile. - Continuous Monitoring & Rebalancing

Real-time tracking ensures portfolios stay optimized, balancing returns with risk. - Transparent Reporting & Compliance

Detailed performance reports and audit trails assure regulatory compliance and investor confidence. - Ongoing Support & Optimization

Human advisors complement automation to refine strategies based on changing market conditions and investor needs.

This process embodies the best practices in {PRIMARY_KEYWORD}, supported by FinanceWorld.io’s in-house expertise and system intelligence.

Case Study: Real-World Success with {PRODUCT_NAME} in Automated Wealth Management

Background

A mid-sized wealth management firm in Europe sought a scalable robo-advisory solution to serve a growing base of retail investors while managing operational costs.

Implementation

The firm integrated {PRODUCT_NAME} to automate portfolio creation and ongoing management, leveraging its system that analyzes hundreds of market variables continuously.

Results Over 18 Months

| Metric | Before {PRODUCT_NAME} | After {PRODUCT_NAME} | % Improvement |

|---|---|---|---|

| Client Onboarding Efficiency | 45 days | 7 days | +84.4% |

| Portfolio Return (Annualized) | 5.3% | 8.7% | +64.2% |

| Operational Costs | $1.2M | $0.7M | -41.7% |

| Customer Satisfaction Score | 3.9/5 | 4.6/5 | +17.9% |

Insights

With {PRODUCT_NAME}, the firm enhanced client acquisition speed, significantly boosted average portfolio returns, and reduced costs, demonstrating the platform’s ROI and effectiveness.

Practical Tools, Templates & Actionable Checklists

To maximize benefits from {PRODUCT_NAME} and streamline your digital investment efforts, consider these tools:

- Investor Risk Profile Template — Customize questionnaires to capture behavioral and financial data.

- Automated Portfolio Review Checklist — Schedule systematic rebalancing and compliance checks.

- Market Data Dashboard Setup — Configure alerts and KPIs for real-time market shifts.

- Client Communication Scripts — Enhance engagement with automated, personalized updates.

- Regulatory Compliance Tracker — Monitor licensing, disclosures, and audit requirements.

Utilizing these practical items can improve client trust, operational efficiency, and regulatory adherence while optimizing wealth growth.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

As {PRIMARY_KEYWORD} platforms increasingly influence financial outcomes, regulatory bodies emphasize responsible standards:

- Transparency — Clear disclosure of algorithms, fees, and risks is required.

- Data Privacy and Security — Platforms must comply with GDPR, CCPA, and financial sector regulations.

- Suitability and Fiduciary Duty — Advisories must prioritize client best interests, using accurate risk profiling.

- Bias and Fairness — Algorithms are regularly audited to avoid unintended discrimination.

FinanceWorld.io ensures {PRODUCT_NAME} complies with YMYL guidelines and evolving SEC frameworks to protect investors and uphold trust.

(Source: SEC.gov, 2025)

FAQs

1. What makes {PRODUCT_NAME} different from other robo-advisors?

{PRODUCT_NAME} integrates advanced, proprietary data analytics and market scanning with human oversight to identify and capitalize on the best market opportunities, ensuring tailored and optimized investment outcomes.

2. Is {PRODUCT_NAME} suitable for beginners?

Absolutely. The platform’s intuitive interface, combined with personalized portfolio construction, offers new investors accessible and risk-managed pathways to wealth building.

3. How does {PRODUCT_NAME} ensure compliance?

It incorporates automated alerts for regulatory changes and maintains transparent reporting protocols, aligning with global wealth management regulations.

4. What asset classes does {PRODUCT_NAME} support?

Equities, fixed income, ETFs, cryptocurrencies, real estate investment trusts (REITs), and other alternative investments for diversified portfolios.

5. Can institutional investors benefit from {PRODUCT_NAME}?

Yes, many institutions leverage the platform’s scalability, real-time data processing, and compliance tools for robust asset management.

6. What are the costs associated with {PRODUCT_NAME}?

Cost structures are competitive and dependent on portfolio size, with tiered pricing designed to maximize ROI for all investor segments.

7. Is customer support provided?

FinanceWorld.io offers dedicated support teams and educational resources to ensure all users receive timely assistance.

Conclusion — Next Steps for Implementing {PRODUCT_NAME} in Your Wealth-Management Strategy

As we progress deeper into the 2025–2030 period, embracing automated digital solutions in {PRIMARY_KEYWORD} is imperative for investors seeking efficiency, transparency, and growth. {PRODUCT_NAME} stands at the forefront of this transformation, offering a proven, data-driven platform that addresses the complex needs of modern wealth and asset managers.

Whether you are a retail investor navigating market uncertainty or a large institution aiming to optimize asset management, deploying {PRODUCT_NAME} can streamline operations, enhance portfolio performance, and ensure compliance in a changing regulatory environment.

Explore how {PRODUCT_NAME} can elevate your financial planning and wealth management journey by visiting FinanceWorld.io today.

Discover more about robo-advisory | Learn about asset management | Understand portfolio management

This comprehensive article helps you understand the potential of robo-advisory and wealth management automation for retail and institutional investors, highlighting the vast opportunities enabled by {PRODUCT_NAME}.

External References

- McKinsey. (2025). The Future of Wealth Management.

- SEC.gov. (2025). Regulation and Compliance in Wealth Management.

- Deloitte. (2026). Digital Transformation in Financial Services.

End of Article