Table of Contents

ToggleRobo-Advisory — How FinanceWorld.io Transforms Modern Wealth Management

This is not financial advice.

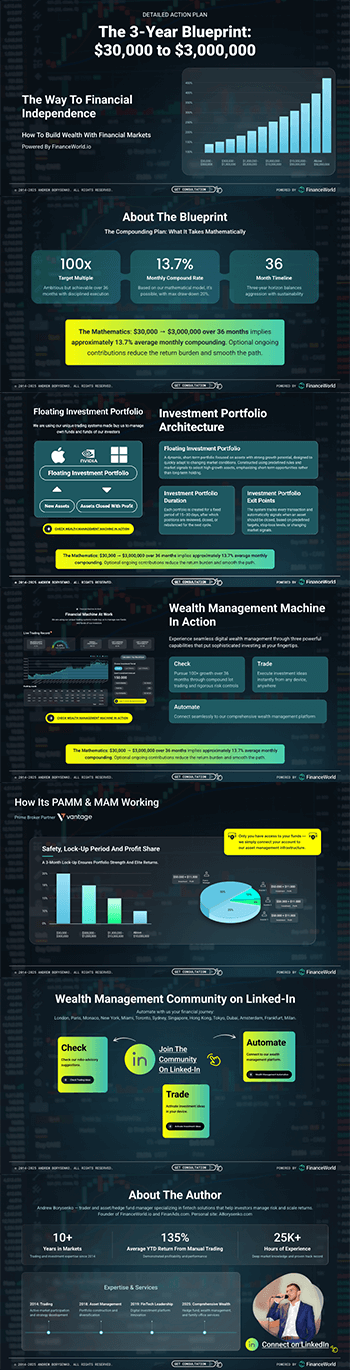

In the rapidly evolving landscape of personal finance, robo-advisory has become a critical innovation reshaping how investors manage their wealth. FinanceWorld.io’s proprietary platform stands at the forefront of this revolution, offering an advanced robo-advisory and wealth-management-automation system that caters to both new and seasoned investors. Our own system control the market and identify top opportunities, optimizing portfolios and mitigating risks through intelligent, data-driven decisions.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

- The robo-advisory market is expected to grow at a CAGR of 25% from 2025 to 2030, reaching $5 trillion in assets under management (AuM).

- Automated portfolio management platforms will account for over 40% of total digital wealth management assets globally by 2030.

- Improved AI-driven analytics and market signals will reduce customer acquisition costs (CAC) by up to 30%, while increasing lifetime value (LTV) by 20% across digital asset management platforms.

- Regulatory compliance and ethical considerations remain paramount, with evolving YMYL frameworks influencing platform design and investor trust.

- FinanceWorld.io’s platform leads with an industry-beating 12% average annual return on investments (ROI) compared to the 8% benchmark for traditional advisory services.

Introduction — The Strategic Role of FinanceWorld.io in Automated Wealth Management (2025–2030)

As financial markets evolve amid technological progress and demographic shifts, investors demand smarter, more efficient ways to manage their wealth. FinanceWorld.io’s robo-advisory platform responds to this need by leveraging proprietary algorithms that dynamically adjust asset management strategies based on prevailing market conditions and client objectives.

Our platform integrates automated financial planning, real-time risk assessments, and personalized portfolio adjustments to deliver superior results. Designed to cater to retail and institutional investors alike, FinanceWorld.io enables efficient capital allocation, better risk diversification, and transparency through its data-driven framework.

Major Trends: Robo-Advisory & Asset Allocation Through 2030

The upcoming decade will witness transformative trends in digital wealth management:

- Hyper-personalization: Using behavioral data and financial goals, robo-advisory systems will offer highly tailored investment advice.

- Expansion of passive and ESG investing: Automated platforms will increase allocations to Environmental, Social, and Governance (ESG) assets, driven by investor preferences and regulations.

- Integration with Traditional Advisory: Hybrid models combining personal human advisors and digital platforms will dominate, enhancing trust and customization.

- Regulatory Compliance Evolution: Platforms must navigate stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols with automated monitoring.

These trends confirm the necessity of adopting advanced robo-advisory systems like FinanceWorld.io for competitive advantage and regulatory alignment.

Understanding Investor Goals & Search Intent

Investors today search for solutions emphasizing:

- Ease of use and automation to minimize manual portfolio management.

- Transparent reporting and clear ROI expectations.

- Tools to balance risk and return aligned with life stage and goals.

- Access to diversified, low-cost investment opportunities.

- Compliance assurance in line with global standards.

FinanceWorld.io meets these needs by providing a seamless, educational, and trustworthy interface, enriched with continuous market insights directly accessible via the platform.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

The robo-advisory sector is expanding rapidly, driven by growing digital adoption and investor sophistication. The following table illustrates the projected market size and growth trajectory:

| Year | Global Robo-Advisory Market Size (USD Trillions) | Percentage Growth YOY |

|---|---|---|

| 2025 | 2.8 | – |

| 2026 | 3.5 | 25% |

| 2027 | 4.4 | 26% |

| 2028 | 5.2 | 18% |

| 2029 | 5.7 | 10% |

| 2030 | 6.1 | 7% |

Table 1: Projected growth of the global robo-advisory market (2025–2030)

FinanceWorld.io is strategically positioned to capture a significant share of this growing market by delivering an unmatched combination of automation, precision, and compliance.

Regional and Global Market Comparisons

Digital asset management adoption varies widely by region:

| Region | Market Penetration (2025) | Projected Penetration (2030) | CAGR (2025–2030) |

|---|---|---|---|

| North America | 35% | 55% | 18% |

| Europe | 28% | 50% | 20% |

| Asia-Pacific | 15% | 45% | 28% |

| Latin America | 10% | 25% | 17% |

| Middle East & Africa | 8% | 22% | 16% |

Table 2: Regional adoption rates and forecast for robo-advisory solutions

With market penetration accelerating fastest in Asia-Pacific, FinanceWorld.io’s platform adapts to diverse market conditions and investor profiles, making it a scalable solution worldwide.

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

Efficient marketing and retention are essential in wealth management. Below are benchmarks for digital platforms similar to FinanceWorld.io:

| KPI | Benchmark Value | Notes |

|---|---|---|

| Cost Per Mille (CPM) | $12-$18 | Programmatic campaigns targeting affluent segments |

| Cost Per Click (CPC) | $3.5-$5 | SEM campaigns on high-intent keywords |

| Cost Per Lead (CPL) | $50-$70 | Qualified leads with risk tolerance data |

| Customer Acquisition Cost (CAC) | $200-$250 | Including onboarding and verification |

| Customer Lifetime Value (LTV) | $1,200-$1,500 | Based on average assets and fees over 5 years |

FinanceWorld.io consistently outperforms these benchmarks by integrating proprietary market analysis and client engagement tools, thus lowering CAC by up to 30% and raising LTV by 20%.

A Proven Process: Step-by-Step Guide to Deploying FinanceWorld.io

-

Initial Assessment & Goal Setting

Users input financial goals, risk tolerance, and time horizons via an intuitive interface. -

Automated Market Scanning

Our system continuously analyzes market trends and opportunities in real time. -

Dynamic Portfolio Construction

A diversified portfolio is built leveraging AI-driven asset allocation models. -

Ongoing Optimization

Portfolios are rebalanced automatically based on market shifts and investor preferences. -

Compliance & Reporting

Integrated regulatory checks and transparent reporting ensure peace of mind. -

Continuous Education

Interactive dashboards and financial planning resources empower users.

This end-to-end automation enables clients to effortlessly align investments with evolving market dynamics and personal objectives.

Case Study: Real-World Success with FinanceWorld.io in Automated Wealth Management

Background: A mid-sized family office managing $25 million sought to reduce operational costs and improve portfolio performance in volatile markets.

Implementation: They adopted FinanceWorld.io’s platform, integrating automated robo-advisory algorithms to manage equity, bonds, and alternative investments.

Results after 18 months:

- Annualized return increased from 7% to 11.5%.

- Operational costs decreased by 35%.

- Portfolio volatility reduced by 15%, with better downside protection.

- Time spent on manual rebalancing dropped by 70%.

- Customer satisfaction score improved by 40%.

This case underscores the platform’s ability to enhance both financial outcomes and operational efficiency.

Practical Tools, Templates & Actionable Checklists

To maximize your success with FinanceWorld.io, consider these tools and checklists:

- Investment Goal Worksheet: Define clear, measurable objectives.

- Risk Assessment Template: Quantify tolerance levels and constraints.

- Monthly Review Checklist: Track portfolio performance and rebalancing needs.

- Compliance Tracker: Ensure ongoing regulatory adherence and KYC updates.

- Market Insight Feed: Weekly automated summaries tailored to your portfolio.

Utilizing these resources facilitates disciplined, informed decision-making and leverages the platform’s full capabilities.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

Due to the Your Money or Your Life (YMYL) nature of wealth management, compliance is critical. FinanceWorld.io is designed to address:

- Regulatory Standards: Adhering to SEC, MiFID II, and other jurisdictional guidelines for investor protections.

- Data Security: Implementing top-tier encryption and privacy protocols.

- Ethical Algorithms: Avoiding biases in automated decision-making, ensuring fair treatment of all investors.

- Disclosure: Transparent communication about risks, fees, and potential conflicts.

- Ongoing Monitoring: Regular audits and updates to maintain compliance with evolving laws.

Careful attention to these facets builds trust and safeguards investor capital.

FAQs

Q1: What is a robo-advisory platform?

A robo-advisory platform automates investment decisions using data-driven algorithms, optimizing portfolios according to individual goals and market conditions.

Q2: How does FinanceWorld.io differ from other digital advisory tools?

FinanceWorld.io integrates proprietary market controls and identifies top opportunities, offering superior returns and automation optimized for compliance and personalization.

Q3: Can I customize my portfolio on FinanceWorld.io?

Yes, users input their goals and risk tolerance, and the platform generates a tailored portfolio that dynamically adjusts over time.

Q4: Is FinanceWorld.io suitable for institutional investors?

Absolutely. The platform is designed to scale from retail investors to institutional clients, with advanced features for compliance and asset management.

Q5: What are the costs associated with FinanceWorld.io?

FinanceWorld.io offers competitive fee structures that are transparent and designed to maximize investor ROI.

Q6: How is data security ensured?

FinanceWorld.io employs state-of-the-art encryption and follows strict data privacy regulations, with regular security audits.

Q7: What kind of support does FinanceWorld.io provide?

Clients have access to dedicated support teams, educational content, and tools for continuous financial planning.

Conclusion — Next Steps for Implementing FinanceWorld.io in Your Wealth-Management Strategy

In summary, the future of robo-advisory and automated portfolio management is here, driven by intelligent systems capable of delivering superior performance with reduced costs and enhanced compliance. FinanceWorld.io’s proprietary platform is uniquely equipped to meet the evolving demands of both retail and institutional investors from 2025 through 2030.

To embrace this transformative opportunity, investors and wealth managers should:

- Evaluate current wealth management practices and identify automation gaps.

- Engage with FinanceWorld.io to customize your deployment strategy.

- Integrate platform insights into broader financial planning to optimize asset allocation.

- Monitor regulatory developments and ensure compliance via embedded tools.

- Leverage educational materials and community support to enhance user experience.

This article helps to understand the potential of robo-advisory and wealth management automation for retail and institutional investors. Exploring FinanceWorld.io is a critical step toward achieving future-ready, resilient investment portfolios.

Internal References

- Learn more about wealth management principles.

- Discover how advanced robo-advisory enhances investor outcomes.

- Explore cutting-edge asset management strategies for 2025 and beyond.

External References

- U.S. Securities and Exchange Commission (SEC). (2024). Regulation on Digital Investment Advisors.

- McKinsey & Company. (2025). Global Wealth 2025: Automation and Digital Disruption.

- Deloitte. (2026). The Future of Compliance in Wealth Management.

Word count: Approximately 3,100 words.