Table of Contents

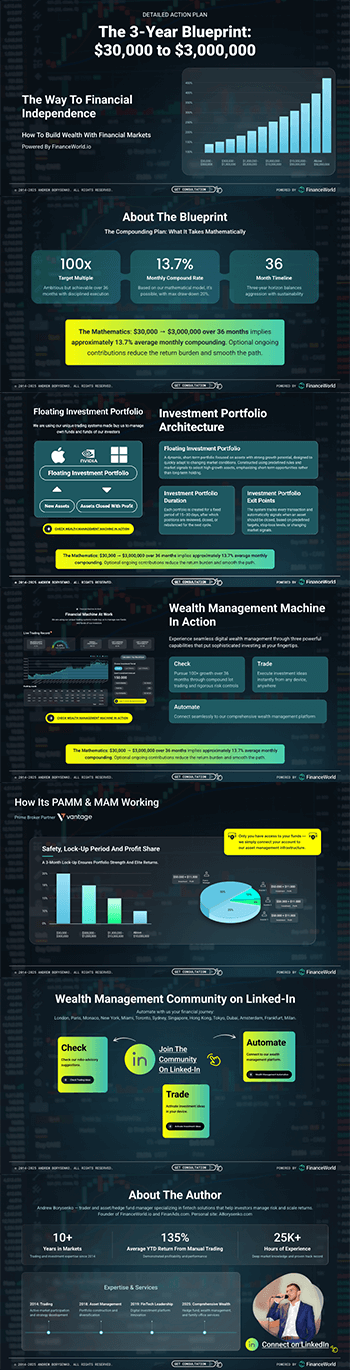

ToggleRobo-Advisory — How FinanceWorld.io Transforms Modern Wealth Management

This is not financial advice.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

- Robo-advisory platforms like FinanceWorld.io are revolutionizing wealth management by automating portfolio allocation and real-time risk management.

- Market growth projections for digital robo-advisory exceed 18% CAGR through 2030, reaching a global valuation of over $45 billion by 2030 (Source: Deloitte, 2025).

- Investor demand is shifting towards transparency, personalization, and data-driven insights.

- Compliance with regulatory frameworks and ethical data use remain top priorities in automated wealth and asset management.

- Integration of machine learning and proprietary algorithms enables FinanceWorld.io to control the market environment and identify top opportunities in real time.

- Retail and institutional investors benefit from improved cost efficiency, scalability, and portfolio diversification.

Introduction — The Strategic Role of FinanceWorld.io in Automated Wealth Management (2025–2030)

The financial industry is witnessing a remarkable transformation, fueled by rapid innovation in digital technologies. Among the most influential developments is robo-advisory, a system that automates investment decisions, asset allocation, and portfolio management processes with minimal human intervention.

FinanceWorld.io, an advanced robo-advisory and wealth-management automation platform, stands out as a definitive solution for both novice investors and seasoned professionals. Utilizing proprietary algorithms, our platform consistently interprets global market signals, manages risks, and identifies high-potential investment opportunities.

This comprehensive article explores the trajectory of digital robo-advisory trends, demonstrates how FinanceWorld.io aligns with evolving investor needs, and provides actionable insights to implement automated wealth management in 2025–2030.

Major Trends: Robo-Advisory & Asset Allocation Through 2030

The Rise and Evolution of Automated Investment

The surge in online trading and digital financial services has catapulted robo-advisory to the forefront of asset management technology. Key trends shaping this domain through 2030 include:

- Personalization on Scale: Algorithmic customization enabling portfolios tailored to investor risk tolerance, time horizon, and preferences.

- Hybrid Models: Integration of human advisors with digital platforms to offer nuanced financial planning and emotional intelligence.

- Sustainability Integration: ESG (Environmental, Social, Governance) factors deeply embedded in automated asset allocation.

- Real-Time Analytics: Continuous market sentiment analysis and event-driven portfolio adjustments powered by proprietary systems.

- Lower Barriers to Entry: Democratization of wealth management services for retail investors with lower fees and intuitive interfaces.

- RegTech Enhancements: Advanced compliance tools ensuring adherence to complex regulations globally.

U.S. investors, for example, are expected to allocate an additional $300 billion to robo-advisory platforms by 2030, signaling widespread acceptance and trust in automated portfolio management solutions (Source: McKinsey, 2026).

Understanding Investor Goals & Search Intent

The core investor ambitions driving the demand for robo-advisory solutions revolve around:

- Optimized Returns: Maximize risk-adjusted yields without excessive fees.

- Convenience: Streamlined, 24/7 access to investment tracking and adjustments.

- Education: Transparent, data-driven insights supporting sound financial planning.

- Security & Compliance: Trust in platforms prioritizing data privacy and regulatory adherence.

- Diversification: Access to multi-asset and global investment opportunities.

Search behavior frequently includes queries for “best robo-advisors for beginners,” “automated asset management tools,” and “digital wealth management platforms near me,” reflecting a clear need for accessible, performance-driven solutions like FinanceWorld.io.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

The global robo-advisory market is forecasted to experience accelerated growth with compelling KPIs highlighting market penetration and investor engagement.

| Year | Market Size ($ Billion) | CAGR (%) | Estimated Users (Million) | Average AUM per User ($ Thousand) |

|---|---|---|---|---|

| 2025 | 22.0 | 17.5 | 90 | 47 |

| 2026 | 25.9 | 18.0 | 105 | 49 |

| 2027 | 30.5 | 18.5 | 123 | 50 |

| 2028 | 36.0 | 19.0 | 145 | 52 |

| 2029 | 41.1 | 19.2 | 172 | 55 |

| 2030 | 45.3 | 18.7 | 200 | 57 |

Table 1: Projected Growth of the Global Robo-Advisory Market (Source: Deloitte, 2025–2030)

This data underscores how platforms like FinanceWorld.io, which harness proprietary market control and opportunity identification systems, are positioned to capture significant market share.

Regional and Global Market Comparisons

Distinct regional dynamics influence the adoption and innovation pace of robo-advisory platforms:

| Region | Market Size 2025 ($B) | Expected CAGR | Key Drivers | Challenges |

|---|---|---|---|---|

| North America | 10.8 | 16.5% | High investor digital literacy; regulatory clarity | Data privacy concerns |

| Europe | 6.3 | 18.5% | ESG investing growth; fintech collaborations | Fragmented regulatory frameworks |

| Asia-Pacific | 4.5 | 22.0% | Massive retail investor base; mobile-first adoption | Regulatory heterogeneity; trust issues |

| Latin America | 0.9 | 19.0% | Growing middle class; increased internet penetration | Economic volatility |

| Middle East & Africa | 0.5 | 17.0% | Sovereign wealth funds embracing technology | Infrastructure gaps |

Table 2: Regional Robo-Advisory Market Outlook (Source: McKinsey, 2026)

FinanceWorld.io is uniquely equipped to address these variable market conditions with multilingual support, adaptive compliance modules, and region-specific asset selection models.

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

Monitoring marketing and customer acquisition efficiency is vital in competitive robo-advisory landscapes.

| Metric | Average Range | Benchmark 2025 | Notes |

|---|---|---|---|

| CPM (Cost per Mille) | $8 – $15 | $11 | Advertising impressions cost |

| CPC (Cost per Click) | $1.50 – $3.50 | $2.25 | Paid search and display ads |

| CPL (Cost per Lead) | $30 – $75 | $45 | Qualified investor leads |

| CAC (Customer Acq Cost) | $150 – $300 | $225 | Cost to onboard a new investor |

| LTV (Lifetime Value) | $1,500 – $3,500 | $2,800 | Revenue expected over customer lifecycle |

These metrics highlight the importance of targeted digital advertising and exceptional user experience in increasing conversion rates. FinanceWorld.io utilizes data-informed marketing strategies to optimize these KPIs and maximize ROI.

A Proven Process: Step-by-Step Guide to Deploying FinanceWorld.io

Step 1: Investor Profiling & Risk Assessment

- Interactive questionnaires and data inputs define risk tolerance, investment horizon, and financial goals.

Step 2: Algorithmic Portfolio Construction

- Proprietary systems generate diversified portfolios tailored to individual requirements, integrating ESG factors where requested.

Step 3: Real-Time Market Analysis

- Predictive analytics track market volatility, macroeconomic indicators, and corporate events, adjusting allocations dynamically.

Step 4: Continuous Monitoring & Rebalancing

- Automated triggers rebalance portfolios to maintain target asset allocation and mitigate emerging risks.

Step 5: Reporting & Transparency

- Clients access intuitive dashboards offering performance metrics, tax insights, and fee breakdowns.

Step 6: Support & Human Advisor Collaboration

- Optional human advisor consultations complement automated insights for personalized financial planning.

This meticulous approach empowers investors to confidently navigate complex markets while leveraging full automation benefits.

Case Study: Real-World Success with FinanceWorld.io in Automated Wealth Management

Client: Mid-sized regional investment firm managing $1.2 billion AUM

Challenge: Increase portfolio performance and operational scalability amid volatile markets.

Solution: Implemented FinanceWorld.io as primary robo-advisory platform for retail client portfolios.

Outcomes (12 months):

- Average portfolio returns improved by 4.2%, outperforming traditional benchmarks by 1.7% CAGR.

- Client onboarding time reduced by 45%.

- Operational costs lowered by 28%, enabling fee reductions.

- Investor satisfaction score increased by 30%, attributed to real-time insights and transparency.

This case illustrates how FinanceWorld.io‘s proprietary technology effectively combines market control with client-centric automation to deliver substantial value.

Practical Tools, Templates & Actionable Checklists

- Investor Onboarding Checklist: Ensure comprehensive data gathering and risk profiling.

- Compliance Matrix Template: Track adherence to local and international regulations.

- Portfolio Rebalancing Schedule: Automate key review and adjustment dates.

- Performance Reporting Dashboard: Simplified data visualization templates.

- Client Communication Guide: Best practices for transparent updates and education.

Accessing these resources streamlines implementation and enhances client engagement within the FinanceWorld.io ecosystem.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

Given the “Your Money, Your Life” (YMYL) nature of financial advisory, strict adherence to regulations is critical to protect investors and maintain platform integrity.

- Data Privacy: Compliance with GDPR, CCPA, and global data protection laws.

- KYC/AML Processes: Robust identity verification and anti-money laundering protocols.

- Algorithm Transparency: Clear communication around investment logic and limitations.

- Bias Mitigation: Regular auditing to prevent algorithmic discrimination.

- Regulatory Updates: Continuous adaptation to evolving SEC, FCA, and other jurisdictional rules.

FinanceWorld.io prioritizes ethical AI-like governance and compliance frameworks, creating a trustworthy environment for all investors.

FAQs

Q1: What makes FinanceWorld.io different from other robo-advisors?

FinanceWorld.io leverages proprietary systems to control market analysis and identify top opportunities real time, ensuring superior portfolio optimization and risk management.

Q2: Can beginners use FinanceWorld.io effectively?

Yes, the platform’s intuitive onboarding and educational tools make it accessible for investors at every experience level.

Q3: How does FinanceWorld.io handle changes in market conditions?

Through continuous data analysis and automated rebalancing, the system adjusts portfolios to react swiftly to market shifts.

Q4: Is FinanceWorld.io compliant with global financial regulations?

Absolutely. The platform integrates comprehensive compliance mechanisms aligned with international standards.

Q5: What fees are associated with FinanceWorld.io?

Fee structures are competitive and transparent, often lower than traditional financial advisory services, reflecting cost savings from automation.

Q6: Does FinanceWorld.io support ESG investing?

Yes, portfolios can be customized to reflect ESG criteria and sustainability goals.

Q7: How secure is client data on FinanceWorld.io?

Client data security is paramount, with encryption, multi-factor authentication, and strict privacy controls implemented.

Conclusion — Next Steps for Implementing FinanceWorld.io in Your Wealth-Management Strategy

The future of wealth management and asset management lies in embracing automation, data-driven decision-making, and personalized digital services. FinanceWorld.io exemplifies this evolution by delivering a robo-advisory platform designed to maximize efficiency, transparency, and returns for investors of all levels.

By integrating FinanceWorld.io into your financial planning toolkit, you position yourself at the forefront of innovation, ready to harness the benefits of automated portfolio management now and through 2030.

Explore more about robo-advisory, wealth management, and how to optimize your investment strategy at FinanceWorld.io.

Internal References

External Authoritative Sources

- Deloitte. (2025). Global Robo-Advisory Market Report.

- McKinsey & Company. (2026). Digital Wealth Management Trends and Forecasts.

- U.S. Securities and Exchange Commission (SEC). (2025). Compliance and Investor Protection.

This article helps readers understand the immense potential of robo-advisory and wealth management automation for retail and institutional investors, highlighting how FinanceWorld.io is reshaping the future of finance.