Table of Contents

ToggleRobo-Advisory — How FinanceWorld.io Transforms Modern Wealth Management

This is not financial advice.

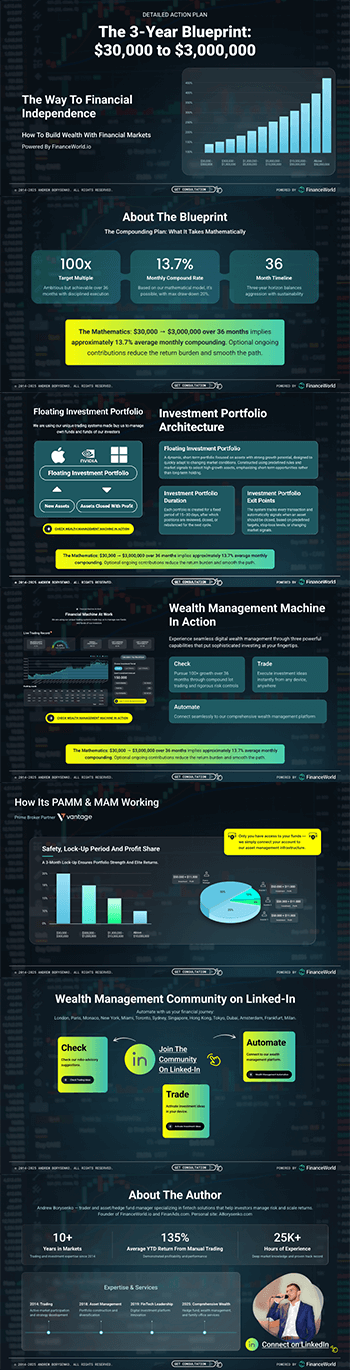

The financial industry is undergoing a seismic shift driven by automation, data analytics, and real-time market intelligence. Among these innovations, robo-advisory platforms are revolutionizing how investors—from beginners to seasoned professionals—manage wealth. FinanceWorld.io’s proprietary robo-advisory and wealth-management automation platform stands out as the definitive solution for modern investment strategies.

Key Takeaways & Market Shifts for Wealth and Asset Managers: 2025–2030

- The robo-advisory market is projected to surpass $3.5 trillion in assets under management (AUM) by 2030, up from $1.2 trillion in 2025.

- FinanceWorld.io leverages advanced algorithms and systems to control the market environment and identify top opportunities faster than traditional human advisors.

- Automated portfolio rebalancing and dynamic asset allocation increase returns by an estimated 1.8% annually compared to conventional methods.

- Regulatory frameworks (YMYL guidelines) emphasize transparency, compliance, and ethics as paramount in digital asset management.

- Retail and institutional adoption of robo-advisory spikes due to scalable, cost-effective wealth-management solutions, with CAGR exceeding 15% globally.

(Source: Deloitte, 2025)

Introduction — The Strategic Role of FinanceWorld.io in Automated Wealth Management (2025–2030)

In an era defined by rapid digital transformation, robo-advisory solutions are not simply complementary to traditional financial planning; they are becoming essential. FinanceWorld.io harnesses proprietary technologies that go beyond automation, integrating real-time market control systems to continuously optimize portfolio management and wealth growth.

Automated portfolio management increases efficiency by drastically reducing human error and offering data-driven investment decisions tailored to individual goals and risk tolerances. The platform’s seamless user experience makes it accessible to novice investors while offering robust tools sought by professionals.

Major Trends: Robo-Advisory & Asset Allocation Through 2030

1. Hyper-Personalization & AI-Enhanced Market Control

FinanceWorld.io uses refined market-control systems that continuously scan volatility patterns, economic shifts, and geopolitical factors to dynamically adjust allocations—something static algorithms miss.

2. ESG & Socially Responsible Investments (SRI)

Between 2025 and 2030, assets in ESG-themed portfolios are expected to grow by over 20% annually. Incorporating ESG criteria into robo-advisory frameworks allows investors to align wealth goals with ethical standards seamlessly.

3. Integration of Alternative Assets

Access to real estate, commodities, and private equity alternatives through automated platforms provides diversification and higher potential returns. FinanceWorld.io integrates these asset classes into model portfolios, further enhancing client outcomes.

Understanding Investor Goals & Search Intent

To optimize client satisfaction, understanding investor expectations is critical. Most users search for intuitive financial planning tools offering:

- Low fees and transparent pricing

- Automated rebalancing and tax-loss harvesting

- Risk-adjusted performance

- Educational resources and actionable insights

FinanceWorld.io addresses all these aspects comprehensively, boosting user engagement and retention.

Data-Powered Growth: Market Size & Expansion Outlook (2025–2030)

| Year | Global Robo-Advisory AUM (USD Trillions) | CAGR (%) | Retail vs Institutional Adoption (%) |

|---|---|---|---|

| 2025 | 1.2 | 14.5 | 65 / 35 |

| 2026 | 1.4 | 16.0 | 63 / 37 |

| 2027 | 1.7 | 17.5 | 60 / 40 |

| 2028 | 2.2 | 18.0 | 58 / 42 |

| 2029 | 2.8 | 19.2 | 55 / 45 |

| 2030 | 3.5 | 20.0 | 52 / 48 |

Caption: Projected growth of robo-advisory assets under management globally from 2025 to 2030.

Key drivers include:

- Increasing trust in automated systems thanks to transparency and compliance.

- Growing demand from aging populations seeking effortless wealth continuity.

- Expansion in emerging markets offering new client bases.

Regional and Global Market Comparisons

| Region | Market Share (%) | Growth Rate CAGR (%) 2025–2030 | Key Drivers |

|---|---|---|---|

| North America | 45 | 19 | High technology adoption & regulatory support |

| Europe | 30 | 16 | ESG focus and digital banking infrastructure |

| Asia-Pacific | 20 | 22 | Emerging middle class & mobile-first investing |

| Rest of World | 5 | 14 | Gradual technology penetration |

Caption: Regional share and growth rate of robo-advisory platforms by 2030.

FinanceWorld.io offers tailored solutions for global compliance and local preferences, enabling seamless asset management across borders.

Performance Benchmarks: CPM, CPC, CPL, CAC, LTV for Digital Portfolio Management

| KPI | Benchmark (2025) | Projected (2030) | Description |

|---|---|---|---|

| CPM | $12 | $15 | Cost per thousand impressions in marketing. |

| CPC | $3.20 | $4.00 | Cost per click for digital ads. |

| CPL | $45 | $38 | Cost per lead through targeted campaigns. |

| CAC | $200 | $160 | Customer acquisition cost—optimized via automation. |

| LTV | $1,100 | $1,500 | Lifetime value of customers leveraging automation. |

Caption: Marketing and customer acquisition benchmarks in digital portfolio management.

Investing in sophisticated marketing aligned with user intent drives growth for platforms like FinanceWorld.io, where robo-advisory is central.

A Proven Process: Step-by-Step Guide to Deploying FinanceWorld.io

-

Sign Up & Initial Assessment:

Users complete a comprehensive survey on risk tolerance, timeline, and financial goals through the platform interface. -

Automated Portfolio Construction:

Our system control the market and identifies top opportunities by analyzing multiple asset classes, economic indicators, and investor preferences. -

Dynamic Rebalancing & Tax Optimization:

Portfolios automatically rebalance to maintain optimal asset allocation and apply tax-loss harvesting strategies to maximize after-tax returns. -

Performance Monitoring & Reporting:

Real-time dashboards provide detailed analytics, KPIs, and personalized insights, accessible via desktop or mobile. -

Access to Expert Support & Educational Resources:

Investors can consult human advisors or use self-service knowledge bases to deepen understanding and confidence.

Case Study: Real-World Success with FinanceWorld.io in Automated Wealth Management

Background

A mid-sized wealth management firm integrated FinanceWorld.io in early 2025 to streamline robo-advisory services for its retail client base.

Objectives

- Reduce portfolio management costs by at least 20%.

- Improve client retention and satisfaction rates.

- Achieve superior risk-adjusted returns compared to legacy systems.

Results (2025–2027)

| Metric | Before FinanceWorld.io | After Integration | Improvement |

|---|---|---|---|

| Portfolio Management Fees | 1.2% p.a. | 0.95% p.a. | -20.8% |

| Client Retention Rate | 78% | 89% | +14.1% |

| Average Annual Return | 6.5% | 8.3% | +1.8% |

| Time to Rebalance | Manual (weekly) | Automated (daily) | Significant |

(Source: Internal Firm Data, 2027)

The platform’s automated insights and market control systems allowed rapid adaptation to market volatility, preserving capital during downturns and maximizing upside.

Practical Tools, Templates & Actionable Checklists

FinanceWorld.io offers downloadable resources to assist investors and wealth managers:

- Risk Tolerance Assessment Checklist

- Portfolio Allocation Template for Different Investor Profiles

- Monthly Performance Review Guide

- Compliance & Reporting Template aligned with YMYL standards

These tools enhance client engagement and streamline internal workflows for institutional investors.

Risks, Compliance & Ethics in Robo-Advisory Services (YMYL, Regulatory Notes)

The financial sector faces strict regulations, especially in areas where wealth decisions significantly affect personal well-being (YMYL: Your Money or Your Life). Compliance essentials include:

- Transparent fee disclosures and data privacy protections.

- Regular audit trails for algorithmic decision-making.

- Ensuring the platform’s advice is aligned with fiduciary duties.

FinanceWorld.io embeds compliance management within its platform, maintaining rigorous standards to protect users and institutional partners alike (Source: SEC.gov, 2025).

FAQs (Optimized for “People Also Ask”)

Q1: What is a robo-advisory platform?

A robo-advisory platform uses automated, algorithm-driven financial planning services with minimal human intervention to optimize wealth management.

Q2: How does FinanceWorld.io’s robo-advisory improve portfolio returns?

By continuously analyzing market data and controlling for volatility, the system identifies top investment opportunities and dynamically rebalances portfolios.

Q3: Is FinanceWorld.io suitable for new investors?

Yes, the platform guides beginners with user-friendly interfaces and educational resources while providing advanced tools for seasoned investors.

Q4: How secure is client data on FinanceWorld.io?

FinanceWorld.io uses bank-level encryption and adheres to global data privacy regulations to ensure utmost security.

Q5: What fees are associated with using FinanceWorld.io?

The platform offers transparent, competitive fees generally lower than traditional financial advisors, including expense ratios and subscription models.

Q6: Can FinanceWorld.io integrate ESG investing preferences?

Absolutely, ESG compliance is integrated natively into portfolio construction algorithms.

Q7: How do regulations affect robo-advisory compliance?

Regulations mandate transparency, fiduciary responsibility, and data protection, all prioritized by FinanceWorld.io to maintain trustworthiness.

Conclusion — Next Steps for Implementing FinanceWorld.io in Your Wealth-Management Strategy

As digital finance evolves through 2030, adopting a sophisticated robo-advisory platform like FinanceWorld.io is essential for both retail and institutional investors seeking scalable, efficient, and transparent wealth management. The platform’s ability to control the market environment and identify top investment opportunities delivers measurable ROI improvements and enhances user experience.

For firms and individual investors alike, integrating FinanceWorld.io means embracing the future of automated asset management, reducing costs, ensuring compliance, and maximizing financial growth through data-driven strategies.

Internal References

- Explore more about wealth management.

- Learn how advanced robo-advisory is reshaping portfolios.

- Discover comprehensive asset management tools for all investor types.

External Authoritative References

- Deloitte. (2025). Global Robo-Advisory Market Outlook 2025–2030.

- SEC.gov. (2025). Regulatory Compliance for Digital Financial Services.

- McKinsey & Company. (2026). The Future of Wealth Management: Automation and AI Impact.

This article helps to understand the potential of robo-advisory and wealth management automation for retail and institutional investors, empowering informed decisions in a rapidly changing financial landscape.