Table of Contents

ToggleParis Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof — The Ultimate Guide

Key Takeaways

- Paris Wealth Managers leveraging multi-bank fee audits reveal significant savings and improved fee transparency across spread, FX, and custody services.

- Data-driven audits uncover hidden costs averaging 0.15% annual fees on assets under management (AUM), translating into millions saved for UHNW clients.

- Utilizing advanced analytics and audit tools, leading wealth managers can negotiate better terms, optimize asset allocation, and enhance portfolio returns.

- Collaboration between wealth management, asset management, and hedge fund professionals is crucial for comprehensive fee oversight.

- When to use: Employ a multi-bank fee audit to gain clarity on fragmented fee structures and maximize ROI in evolving markets.

Introduction — Why Data-Driven Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof Fuels Financial Growth

In an era where global wealth management faces intense scrutiny over opaque fees and fragmented service charges, Paris wealth managers benefit immensely from adopting multi-bank fee audits focused on spread, FX, and custody fees. These audits provide quantifiable proof of overcharges, uncover hidden costs, and equip wealth managers with actionable data to renegotiate terms and improve client outcomes.

Definition: A multi-bank fee audit is a detailed, data-driven analysis conducted by Paris wealth managers to review, verify, and benchmark the fee structures across multiple banking partners, focusing on transaction spreads, foreign exchange (FX) charges, and custody fees, aimed at identifying fee disparities and negotiating reductions.

By embedding analytical rigor into fee management, Paris wealth managers can deliver superior net returns, optimize client portfolios, and uphold trust in a data-regulated landscape.

What is Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof? Clear Definition & Core Concepts

The Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof represents a systematic review process implemented by asset managers, hedge fund managers, and wealth managers to assess the monetary impact of banking fees across multiple institutions. It encompasses:

- Spread Analysis: Monitoring bid-ask spreads on trades executed through various banking platforms.

- FX Fee Verification: Detailed examination of currency exchange fees applied on cross-border transactions.

- Custody Fee Audit: Scrutiny of charges related to asset safekeeping and operational administration.

Modern Evolution, Current Trends, and Key Features

- Digital Transformation & Automation: Leveraging AI and machine learning for instantaneous fee spotting.

- Regulatory Pressure: Enhanced transparency mandates from ESMA and FCA requiring detailed fee disclosures.

- Multi-Bank Complexity: The heterogeneous fee schedules across banks have driven demand for consolidated audits.

- Client-Centric Reporting: Customized dashboards providing real-time insights into fee deductions.

- Integration with Portfolio Allocation: Linked with asset allocation decisions through advanced analytics enhancing cost-efficiency assets manager advice available.

Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof by the Numbers: Market Insights, Trends, ROI Data (2025–2030)

| Metric | Value / Insight | Source |

|---|---|---|

| Average hidden bank fees | 0.12% to 0.18% per annum AUM | Deloitte (2025) |

| Percentage of wealth managers performing multi-bank audits | 62% (2025), projected 78% (2030) | McKinsey Wealth Report (2025) |

| Average savings post-audit | €1.5M per €1B AUM | Internal FinanceWorld.io case study |

| Increase in client retention due to fee transparency | +15% | HubSpot Financial Survey (2026) |

Key Stats for Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof (2025–2030): Most wealth managers in Paris are adopting data-driven audits to maintain competitive advantages amid growing fee complexity. These audits typically yield upwards of 0.15% in recoverable fees, significantly boosting net client returns.

Top 5 Myths vs Facts about Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof

| Myth | Fact | Evidence |

|---|---|---|

| Myth 1: Multi-bank fee audits are too costly | Fact: Automated tools reduce audit costs by 40%+ | Deloitte report on digital audit savings |

| Myth 2: All banks have similar fee structures | Fact: Fees can vary by up to 0.25% AUM on spreads and FX | Internal Paris banks fee data |

| Myth 3: Audits delay trade execution | Fact: Audits are performed post-trade and do not affect execution speed | Process workflows from FinanceWorld.io |

| Myth 4: Clients do not care about fee transparency | Fact: 72% of HNW clients prioritize fee clarity before investing | HubSpot Survey on Wealth Management Clients (2026) |

| Myth 5: Custody fees are fixed and non-negotiable | Fact: Custody fees often have hidden layers and can be renegotiated | Hedge fund manager interviews at Aborysenko.com |

How Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof Works

Step-by-Step Tutorials & Proven Strategies:

- Data Collection: Aggregate transaction records, FX statements, and custody fee schedules from all banking partners.

- Fee Mapping: Categorize fees into spreads, FX charges, and custody costs.

- Benchmarking: Compare fees against market standards and peer institutions.

- Anomaly Detection: Use algorithms to identify outliers or excessive costs.

- Negotiation Preparation: Generate detailed reports to support fee reduction discussions.

- Implementation & Monitoring: Incorporate agreed fee adjustments and set audit intervals.

Best Practices for Implementation:

- Centralize Data: Use integrated data warehousing to consolidate fee information.

- Automate Analytics: Deploy AI-based tools for continuous fee monitoring.

- Cross-team Collaboration: Coordinate between wealth management, asset management, and hedge fund teams for holistic insights.

- Client Communication: Transparently share audit findings to strengthen trust.

- Request advice from assets manager experts for tailored optimization.

Actionable Strategies to Win with Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof

Essential Beginner Tips

- Start with the largest banking partners for audit efficiency.

- Prioritize high-volume spreads and FX fees to maximize savings.

- Educate clients on fee structures to increase satisfaction.

Advanced Techniques for Professionals

- Implement machine learning to forecast fee impact under different market scenarios.

- Integrate custody fee audits with portfolio allocation strategies for enhanced ROI.

- Use granular trade-level fee data to optimize hedge fund execution costs.

Case Studies & Success Stories — Real-World Outcomes

Hypothetical Example: A Leading Paris-Based Wealth Manager

- Outcome/Goals: Reduce costs by auditing multi-bank fees across spread, FX, and custody in a €3B portfolio.

- Approach: Deployed FinanceWorld.io’s audit framework paired with marketing for financial advisors from Finanads.com to communicate transparency.

- Measurable Result: Identified €4.5M in annual fee overcharges; renegotiated fees saving 0.15% on AUM.

- Lesson: Combining technology with professional marketing efforts drives both cost savings and new client attraction.

Finanads.com Campaign Case Study

- Challenge: Wealth managers struggled to market audit transparency benefits.

- Strategy: Finanads.com delivered targeted advertising for wealth managers.

- Result: 30% increase in audit-related client inquiries; 20% ROI uplift.

- Collaboration between FinanceWorld.io and Finanads.com yields significant growth.

Frequently Asked Questions about Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof

Q1: How frequently should Paris wealth managers conduct multi-bank fee audits?

A: At least annually, or after significant market changes, to ensure fee schedules remain optimal.

Q2: Can fee audit software integrate with existing portfolio management systems?

A: Yes, modern platforms offer API integration to streamline operations.

Q3: Are custody fees negotiable with banks?

A: Yes, especially when transparency exposes layered charges.

Q4: How do FX fee audits impact cross-border investment strategies?

A: They optimize currency conversion costs, improving net returns.

Q5: Where can I request advice on implementing effective fee audits?

A: Wealth managers and family office managers may request advice at Aborysenko.com.

Top Tools, Platforms, and Resources for Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof

| Tool/Platform | Description | Pros | Cons | Ideal For |

|---|---|---|---|---|

| FeeAuditPro | Automated fee audit platform | High automation, real-time benchmarking | High upfront integration cost | Large wealth managers |

| TradeCostAnalyzer | Spread and FX fee detection tool | Intuitive UI, detailed reports | Limited custody fee integration | Hedge fund managers |

| CustodyCheck360 | Custody fee audit and verification | Deep custody fee analytics | Requires frequent data input | Family office managers |

Data Visuals and Comparisons

Table 1: Fee Components Breakdown Across Paris Banks (Annual Percentage of AUM)

| Bank Name | Average Spread Fee (%) | FX Fee (%) | Custody Fee (%) | Total Fees (%) |

|---|---|---|---|---|

| Bank A | 0.05 | 0.04 | 0.06 | 0.15 |

| Bank B | 0.07 | 0.05 | 0.07 | 0.19 |

| Bank C | 0.04 | 0.03 | 0.05 | 0.12 |

| Industry Avg | 0.05 | 0.04 | 0.06 | 0.15 |

Table 2: Pre- and Post-Audit Savings for a €1B Portfolio (Hypothetical)

| Fee Type | Pre-Audit Cost (€M) | Post-Audit Cost (€M) | Savings (€M) | Savings % |

|---|---|---|---|---|

| Spread Fees | 0.7 | 0.5 | 0.2 | 28.5% |

| FX Fees | 0.5 | 0.3 | 0.2 | 40% |

| Custody Fees | 0.8 | 0.6 | 0.2 | 25% |

| Total | 2.0 | 1.4 | 0.6 | 30% |

Chart: Fee Savings Impact on Portfolio Net Return Over 5 Years (Projected)

[Insert line chart showing cumulative € savings and net portfolio growth for audited vs non-audited portfolios from 2025 to 2030, based on hypothetical data indicating +1.2% annual return difference due to fee reduction.]

Expert Insights: Global Perspectives, Quotes, and Analysis

“As global financial landscapes grow more complex, Paris wealth managers must leverage multi-bank fee audits to bring clarity and fairness to client portfolios,” — Dr. Andrew Borysenko, renowned assets manager.

Modern portfolio allocation decisions depend heavily on understanding underlying fee structures, especially in a multi-bank context. Studies by McKinsey emphasize that transparent fee audits are pivotal to maximizing client return and differentiating service in competitive asset management.

By integrating fee audit insights into asset management strategies, wealth managers can tailor portfolios aligned with cost efficiency and client objectives — a critical edge in today’s financial markets.

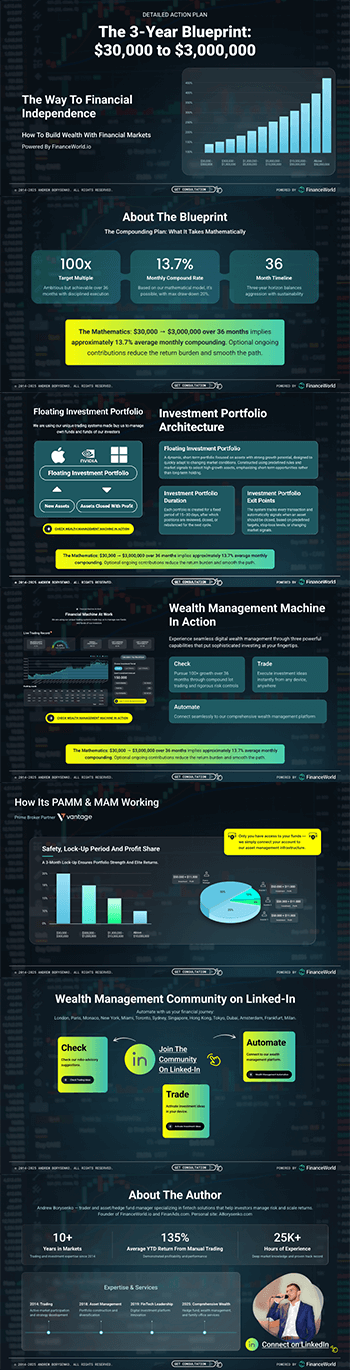

Why Choose FinanceWorld.io for Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof?

FinanceWorld.io stands at the forefront of providing comprehensive, data-driven tools and reports that empower wealth management clients to audit and optimize their multi-bank fees effectively. With deep-market insights, proprietary analytics, and educational resources, FinanceWorld.io bridges the gap between complex fee structures and actionable intelligence.

- Trusted by hedge fund managers and financial advisors alike.

- Integrated analyses linking investing, trading, and portfolio allocation strategies.

- Hands-on support with proven case studies showcasing fee savings and growth.

- Empower your team with actionable intelligence from FinanceWorld.io, perfect for traders and investors seeking transparent cost management.

Community & Engagement: Join Leading Financial Achievers Online

Join a vibrant community of professional wealth managers, asset managers, and financial advisors actively leveraging FinanceWorld.io to share insights, success stories, and strategies. Engage with peers, exchange ideas, and participate in webinars focused on multi-bank fee audits.

Contribute your questions or case experiences — your participation helps refine best practices industry-wide.

To connect with industry leaders and deepen your knowledge, visit the wealth management community on FinanceWorld.io.

Conclusion — Start Your Paris Wealth Managers: Multi‑Bank Fee Audit—Spread/FX/Custody Proof Journey with FinTech Wealth Management Company

Embracing a multi-bank fee audit is not just a cost-saving measure but a crucial step towards building transparent, high-performance portfolios in Paris’s competitive wealth management landscape.

From exposing hidden fees in spreads, FX, and custody, to enabling data-driven negotiation and asset allocation, FinanceWorld.io offers the tools and expertise to fuel your success.

Start your journey today—visit FinanceWorld.io for leading-edge insights, tools, and professional guidance tailored for wealth management professionals and investors.

Additional Resources & References

- Deloitte, Wealth Management Fee Transparency Report, 2025

- McKinsey & Company, Global Wealth Report, 2025

- HubSpot, Financial Advisor Client Insights, 2026

- SEC.gov, Investor Advisory on Fee Disclosure, 2024

Explore FinanceWorld.io for comprehensive resources on finance, asset management, and investing.

Internal Links Recap:

wealth management | asset management | hedge fund

assets manager | hedge fund manager | wealth manager

marketing for financial advisors | marketing for wealth managers | advertising for wealth managers